Exchange Rate Volatility and Portfolio Flows : A State Dependent and Heterogeneous Relationship, Evidence from Emerging Market Currencies

Süleyman Hilmi KAL*

Republic of Turkey Ministry of National Education, Ankara, Turkey.

*Corresponding Author

Süleyman Hilmi KAL,

Republic of Turkey Ministry of National Education, Ankara, Turkey.

E-mail: Suleyman.Kal@tcmb.gov.tr

Received: September 07, 2021; Accepted: November 11, 2021; Published: November 15, 2021

Citation: Süleyman Hilmi KAL. A Contemporary Approach to Customer Relationship Management. Int J Financ Econ Trade. 2021;4(2):100-107. doi: dx.doi.org/10.19070/2643-038X-2100013

Copyright: Süleyman Hilmi KAL©2021. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.

Abstract

In this paper, we investigated whether the relationship between bond and equity portfolio ows and exchange rate volatility

diers during times of high risk and low risk measured by VIX and existence of heterogeneity between among emerging

market (Brazil, Chile, Turkey, Mexico, Indonesia, Russia, Poland, South Africa)currencies. To this end, using weekly data, we

imple-mented two levels of analysis; rst, aggregate level, we employed impulse response functions of the PVAR method, and

second, at the individual level, we employed impulses responses of the MSVAR model. Our results point a very diverse and

state-dependent relationship between portfolio ows of both types and exchange rate volatilities.

JEL Codes: F31, F32,C32, C33

2.Introduction

3.A Look At Some Stylized Facts

4.Review Of Some Related Empirical Literature

5.The Method

6.The Results

7.Summary and Conclusion

8.References

Keywords

Exchange Rate Volatility; Markov Switching VAR; Panel VAR.

Introduction

Recent surge in the observed volatility of the exchange rates is

linked to liberalization of capital markets and increasing magnitude

and volatility of short term capital flows [3, 1, 8, 14, 2, 12, 6,

10, 4, 13]. Impact of cross-border short term capital flows (portfolio

flows) on exchange rate volatility is documented to be far

from being homogeneous among the different currencies with

similar exchange rate regimes and economic fundamentals [9].

Furthermore, it is also reported that impact of portfolio flows are

state dependent [5, 11].

Investigating the effects of equity and bond inflows for seven

Asian countries, [4] document that net equity (bond) inflows drive

the exchange rate to a high (low) volatility state. [9] Provide empirical

evidence of the existence of different exchange rate volatility

between floating ex- change rate countries with similar macroeconomic

fundamentals as a result of ‘noise trading’ in the foreign

exchange markets due to probable non-fundamental channel in

the link between exchange rate regimes and exchange rate volatility.

Arguing that investors react differently in different states of

the market, [11] shows that the relationship between exchange

rates and capital flows evolves over time and it is different under

different exchange rate volatility condi- tions. [4] investigates the

effects of bond and equity flows on the exchange rate volatility

of seven emerging developing Asian economies. They provide

evidence suggesting the association of high (low) exchange rate

volatility with equity (bond) inflows with one exception. They

conclude that capital controls could be an effective tool to stabilize

the foreign exchange market in countries where flows affect

exchange rate volatility. [12] find that high interest rate currencies

are negatively related to innovations in global FX volatility,

and thus deliver low returns in times of unexpected high volatility,

when low interest rate currencies provide a hedge by yielding

positive returns.[5], brings evidence on this issue from six emerging

markets that raising nominal interest rate lead to higher probability

of crises regime by utilizing a Markov regime switching

specification.

In this paper, using a weekly data set of major emerging markets

we will further investigate the issue of time-varying state dependent

impact of portfolio flows on for the currencies of emerging

markets (Brazil,Chile, Indonesia, Mexico,Philippines,Poland,

Russia, S.Africa, Turkey) for the period between 2004-2019. We

will proceed with two level of analysis for each type of portfolio

flow (equity and debt); first at ag- gregate level employing impulse response functions of Panel Data VAR method, we look

into general tendencies for the whole sample for different subtime

periods divided depending on the global risk appetite measured

by VIX. Second, using a two state Markov Switching Vector

Auto Regression (MSVAR) method, we analyze state dependent

effects of portfolio flows for each individual currency separately

to investigate heterogeneous impact of both type portfolio flows

among the countries and among the different type periods based

on global risk appetite.

Our contribution to literature is multi-fold. First, in our best

knowledge, this is the first study analyzing this relationship both

at aggregate and country level. Second, we showed that at the aggregate

level the relationship between bond flows, equity flows,

and exchange rate returns differ depending on the state of the

global risk appetite. Third, we provide further evidence at the individual

country level that the impact of bond and equity flows on

emerging country currencies show great heterogeneity.

The rest of the paper is as follows. In section next section Background

and Data, we will explain the data and visually look in

to the relationship between equity and bond flows and exchange

volatility with graphs for full period and for sub-periods. In the

third section, the econometric methods employed in this paper

will explained.

We will discuss the results in Section 4 and Section 5 will be conclusion

and policy implications.

Data and Background

Sample countries are Brazil, Turkey, Mexico, Argentina, South

Africa, Indone- sia,Poland, Philippines and Chile. Data used in

the paper is obtained from IRRF and Bloomberg data bases. The

periodicity of the portfolio flows, exchange rates and VIX are

weekly. Realized monthly volatility is calculated from daily data

for thirty days.

Mai objective of this paper is to investigate the existence of state

dependent relationship between portfolio flows and exchange

rate volatility at aggregate and country levels and heterogeneity

among the sample countries. Before quantifying this relationship

with econometric techniques, as a natural first step, we divided

sample period into sub-sample periods based on the state of the

global economy and compare and contrast the statistical properties

of the portfolio flows and the the exchange rates of each

country for each sample period. We determined sub- sample periods

based on the state of the global economy as flows: Pre-Financial

Crises Period: 2004-2008, Financial Crises Period: 2008-2013,

Post Financial Crises Period: 2013-2019.

Full Sample: 2004-2019

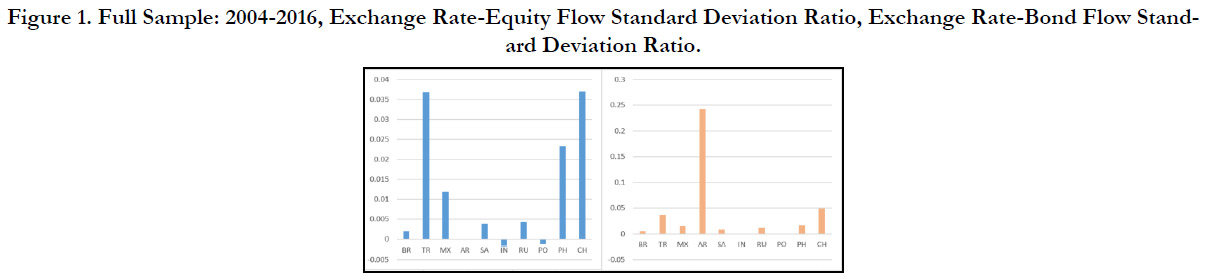

Figure 1 is intended to show comparative impact of the volatility

of equity and bond flows to the volatility of exchange rates

for the whole sample period:2004- 2019. Drawing these figures,

we first calculated coefficient of variation (stdv/mean) for equity,

bond flows for each country and ratio them to the coefficient of

variations of the each currency. The first graph of Figure I is for

equity flows and the second graph is for bond flows. For the first

graph, Argentinian peso was eliminated as an out-lier. It is evident

in the figure that other than Argentina, the volatility of both equity

and bond flows are comparatively greater affect on the the

volatility the currencies of Turkey, Chile and Poland.

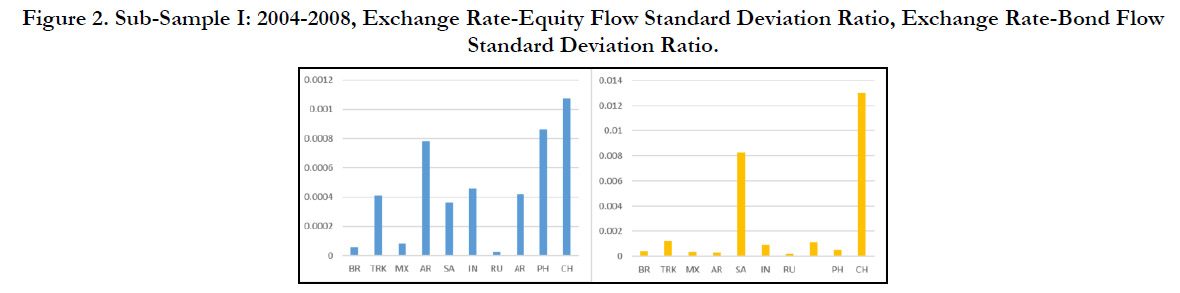

Sub-Sample I: 2004-2008

This is the period which covers relatively calm period before the

great financial crises during which portfolio flows reached all time

high levels. Figure shows that affect of equity and bond portfolio

flows are heterogeneous the countries in sample. Compared with

Figure 1 it is evident that exchange rate volatility associated with

bond and equity flow volatility is lower during this sub-period

compared to the whole period and Chile,which has the most liberal

capital markets for this period, seems to have highest impact.

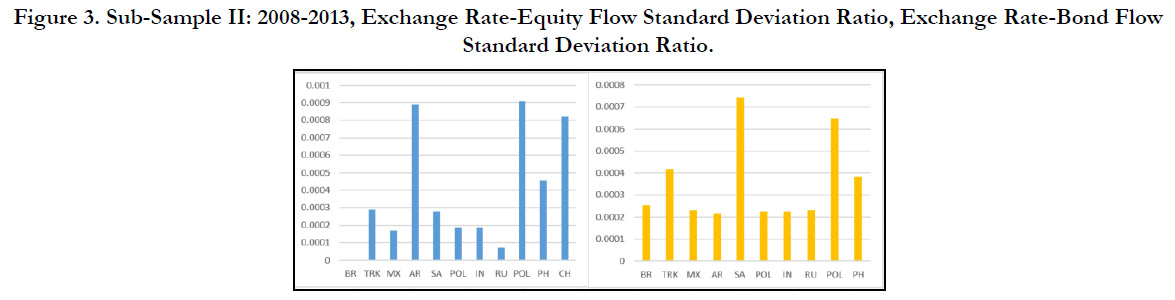

Sub-Sample II: 2008-2013

This is the crises period marked first by the 2008 Lehman Brother

crises and second with Euro era crises caused mainly by Greek,

Spain and Portuguese economies. We choose June of 2013 as the

end of liquidity abundance period with US FED president Ben

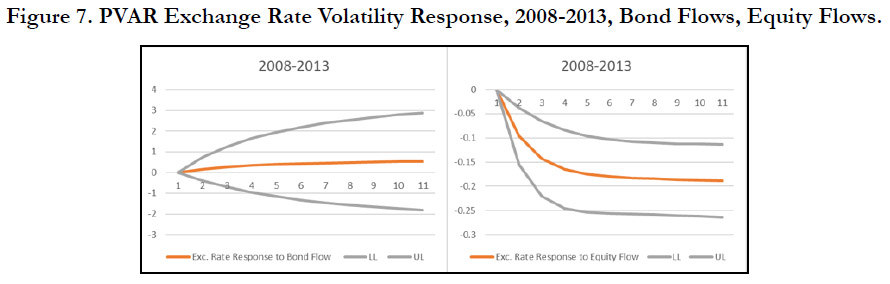

Bernanke’s famous tapering speech. Figure 7 shows the how volatility

of equity and bond portfolio flows affect volatility of the

currencies of the sample countries during this period. Compared

with the previous period, impact of the volatility of portfolio

flows on exchange rate volatility is smaller. During this 2008-2013

volatility of Chilean peso is more exposed to volatility of portfolio

flows than the other currencies. Currencies of Brazil, Mexico,

Russia are more resilient to the volatility of the equity and bond

flows.

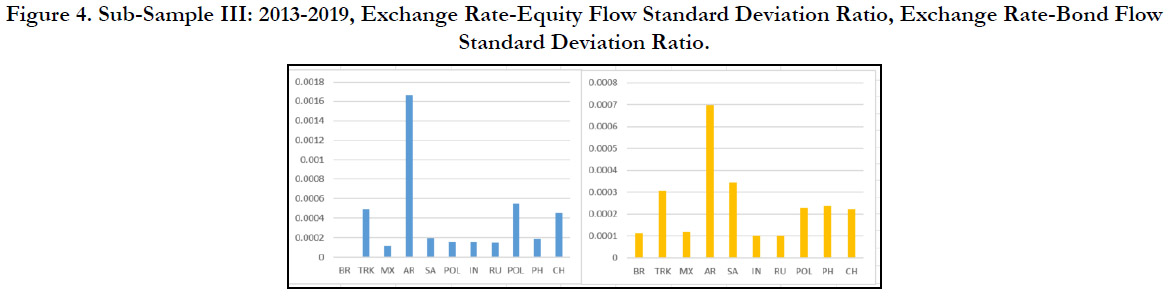

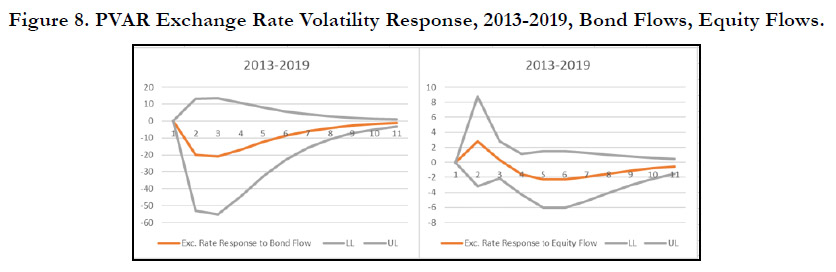

Sub-Sample III: 2013-2019

The last sub-period that we analyzed is post-tapering speech period,

during which the global liquidity is reduced gradually. Figure

7 shows the how volatility of equity and bond portfolio flows

affect volatility of the currencies of the sample countries during

this period. Compared with the previous period (2008-2013),

impact of the volatility of equity flows on exchange rate volatility

is greater; again compared with pre-crises period, impact of the equity flows is greater but that of bond flows is smaller. During

this period countries like Argentina, Turkey are more vulnerable

for both types of flows.

Global risk appetite according to which states in the MSVAR

model is deter- mined by VIX value and CDS values for each

country is used in MSVAR model to govern time-varying transition

probabilities.

Methodology

Panel VAR

As briefly explained above both exchange rates and portfolio flows

affect each other,so the relationship between portfolio flows and

exchange rate returns is en- dogenous. Thus, in aggregate level,

we investigated this relationship by employing the panel data VAR

method, which combines endogeneity of all the variables in the

system of VAR method with unobserved individual heterogeneity

of the panel data method.The model formulated as follows:

where Zit is a vector of three variables: Exchange Rate Volatility

of Sample Coun- tries, Bond Flows to Sample Countries,

Equity Flows to Sample Countries. We used Granger causality

test to determine te order of the variables. The order selection

criteria suggest all endogenous variables to enter the model with a lag. Unobservable time-invariant fixed effects such as different

exchange rate regimes, country size, and financial regulation, at

country level is included in the model with the term fi. For- ward

mean-differencing is used to eliminate the correlated effects stemming

from lagged regressors by preserving the orthogonality between

transformed variables and lagged regressors with system

GMM12. Common time effects for all currencies such as to capture

any global macro economic shocks that may affect all countries

in the same way.For example, time effects capture common

factors such as key in- terest rates, spreads or global risk factors

are added to the model with dt. This is equivalent of putting time

dummies in the system.

Markov Switching Exchange VAR Model

Fixed effect panel VAR estimation provides a general idea about

relationship be- tween capital flows and exchange rates. Detecting

the existence of heterogeneity with respect to countries and

with respect to time periods requires analyzing each currency

separately with a method which allows state dependent and nonlinear

analysis. Regime depended analysis provides a better frame

work to investigate the relationship between exchange rate return

and portfolio flows depending on global risk appetite than dividing

sample period into sub-periods. Vector auto regres- sion will

allow us to address the endogeneity of the relationship between

exchange rate returns and portfolio flows. Thus, a two-state time

varying transition probabil- ity Markov Regime Switching Vector

Autoregressive Regression (MSVAR) model is employed in this

paper.

[7] who use the Markov regime switching models in econometrics

are pioneers in this litera- ture. Later on it is Hamilton(1990) who

popularized Markov switching models. In Markov models, an observable

variable yt depends on state variables which are not directly

observed. Here st is used for state variable definition. States

are defined as State 0, State 1.. State N. State variables, which are

not observed, evolve follow- ing a Markovian regime change. st,

state variable governs the distribution of each period. Thus, in

our model there are two distributions each with different means

and variance of yt which are based on the respected state. The

purpose of using Markov regime changing model in this paper is

to investigate whether relationship between exchange rate returns

and portfolio flows depend on global risk apatite. We choose Chicago

mercantile index VIX as the criteria to determine states of

high risk appetite and low risk appetite.

Markov switching approach utilized in this paper is briefly summarized

as follows:

Thus, in case st = 0 the observed changes of yt is a random

draw from distribution ( ) 0 0

/ ~ , 2 t t s s y s N μ σ and in case st = 1,

the observed changes of yt is a random draw from distribution

( ) 0 ~ /tt s y s N μ .

The probability density of yt conditional on state variable is formulated

as follows:

Transition between the states is only based on the previous state.

Transition probability is defined as the probability of switching

from one state to another state. Transition probabilities can be

constant, as Hamilton suggested in his very well cited work (Hamilton,

1989), or it can be time varying, as developed by Diebold,

Wein- bach and Lee (1994). In the Hamiltonian framework, the

probabilities of switching between the states are fixed, exogenous

and do not vary over time. For example, the transition from State

(t - 1) to State (t) is shown as: ( 1) ( | ) t t ij P s i s j P − = = =

These features of the model limit the explanatory power of the

Markov process. Allowing transition probabilities to change over

time, depending on a vector of variables, enriches the Markov

process by enabling it to model the underlying process of transitional

dynamics explicitly. Hamilton's constant transition model

is later evolved by Diebold, Weinbach and Lee (1994) by addition

of time-varying transition probabilities which are estimated with

logistic functions of vector of (x(t - 1)) as follows:

Since Sims (1980) study, Vector Autoregressive model has become

one of the major tools of empirical studies. Krolzig (1997)

introduces the regime changes to vector autoregressive model.

An MSVAR model provides framework of modeling multivariate

representation of related variables non-linearly. Following bond

and equity portfolio ows and exchange rate model is designed

with Markov specication, for each currency VAR of bond ows,

equity ows and exchange rate returns is model as follows:

where Φ is state dependent constant term, Yst state vector is

ranked as bond flows,equity flows and exchange rate return

(against USD) for each currency, Ωst error term.

According to this model, we will have a time varying transition

probability two state Markov switching autoregressive model.

State O is defined as the periods during which VIX index is less

than 25 and State 1 is the periods during which VIX index is higher

than that threshold level. We assume risk appetite is low in State

I and high in State 0. Thus, the model used is in this paper is to

see whether the relationship between both of the portfolio capital

flows and exchange rate volatility demonstrate any difference

between the states.

The impulse response functions uses Cholesky decomposition

and impulses are defined as one standard deviation positive

shocks the variables.

Empirical Results

Aggregate Model: PVAR Exchange Rate Volatility

In section impulse response graphs of PVAR model are presented

and discussed. As indicated in the previously sample period

in divided into four sub-periods to ana- lyze whether volatility

of exchange rate react differently to equity and bond flows depending

on the global risk appetite measured by VIX index: Precrises

Period: 2005-2008; Crises Period:2008-2013 and Post-crises

Period:2013-2019. The response of exchange rate volatility to a

one-standard-deviation shock to bond flows and eq- uity flows

are plotted. All graphs show responses for the first 10 quarters.

Upper and lower limits of are 90th percentile bounds constructed

using Monte Carlo simulations with 500 repetitions.Each of the graphs also plots the zero line.

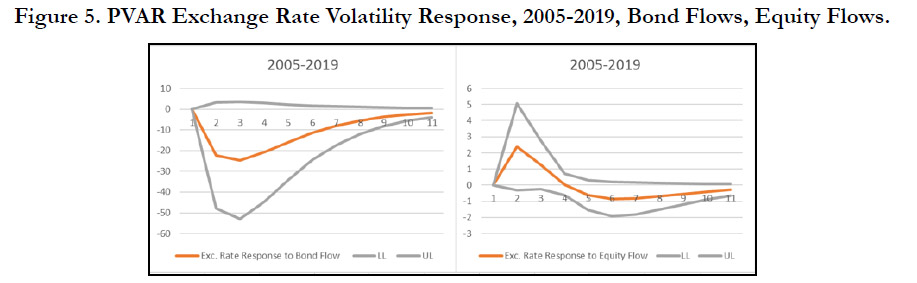

Figure 5 shows aggregate volatility response of sample countries

to the impulses of equity and bond flows for the full-period,

2005-2019. The first graph of Figure 1 indicate that bond flows

reduce exchange rate volatility, second graph of Figure 1 on the

other hand portrays a different outcome for equity flows, equity

flows initially increase the volatility of exchange rates for four

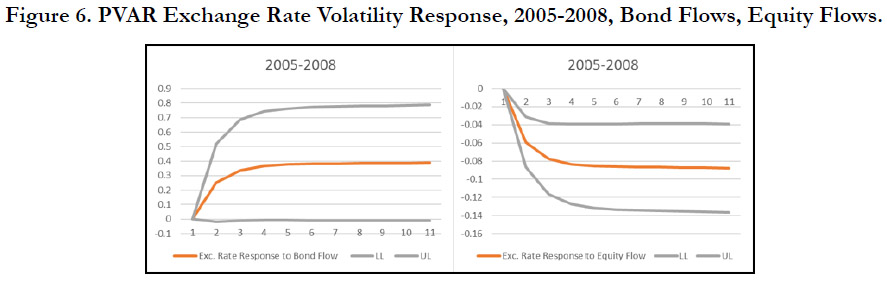

periods before it is reduced. Results shown in Figure 6 are for

pre-crises period, 2005-2008 are different from the whole sample

period; bond flows during this period increase exchange rate

volatility permanently, while equity flows decrease it permanently.

During the great financial crises period (2008-2013) bond flows

do not have significant impact on exchange rate volatility, while

equity flows reduce it permanently. Post-crises period relationship

is similar to hat of the whole sample period.

Impulse response figures of PVAR method provides evidence

that heterogeneous response of exchange rate among different

period between 2004-2019 provide ev- idence that exchange rate

volatility portfolio flows relationship is not linear and depending

on the investors’ risk appetite both types of portfolio flows sometimes

reduce sometimes elevate exchange rate volatility. After detecting

this important pattern from aggregate analysis, as a natural

next step we will discuss the results of same VAR ranking analysis

for implemented to individual currencies separately by employing

MSVAR frame work in the next session.

Impulse response figures of PVAR model indicate that aggregate

the relationship between bond and equity portfolio flows is heterogeneous

across the different periods.

Exchange Rate Volatility Model Markov Regime Switching

VAR Models

MSVAR framework allows to model state dependent variables. In

the previous sec- tion, results imply that at aggregate level both

types of portfolio flows and exchange rate volatility are not linear

and vary depending on the global risk appetite mea- sured by

VIX. As explained above we employed MSVAR method for each

currency separately to investigate state dependent impact of portfolio

flows on exchange rate volatilities. In this context, States of

MSVAR model is determined based on VIX value. A VIX value

of higher than 25 is determined as high risk low risk appetite state

and a VIX value of lower than 25 is determined as periods of low

risk state.

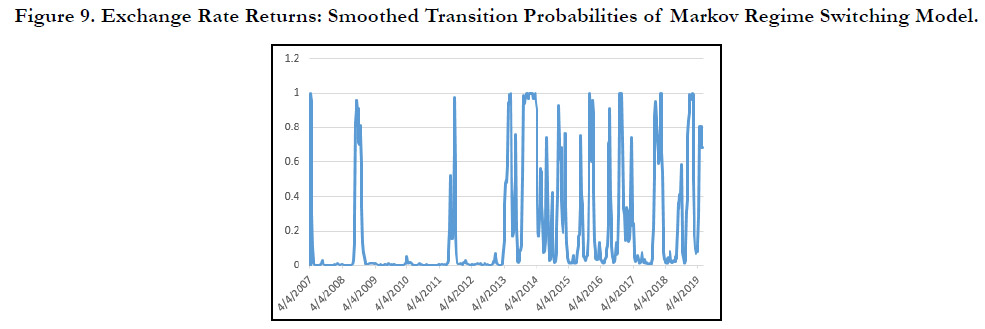

Figure 9 shows he smoothed transition probability of being at

State 1 of MSVAR model. This figure compared to sub-periods

of PVAR analysis shows a more nu- anced state depended analysis.

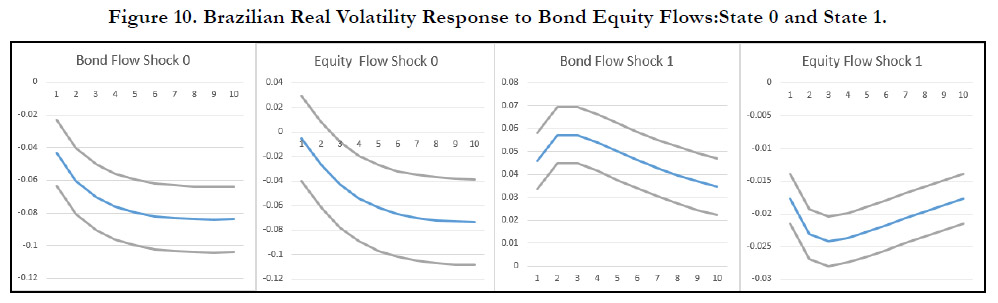

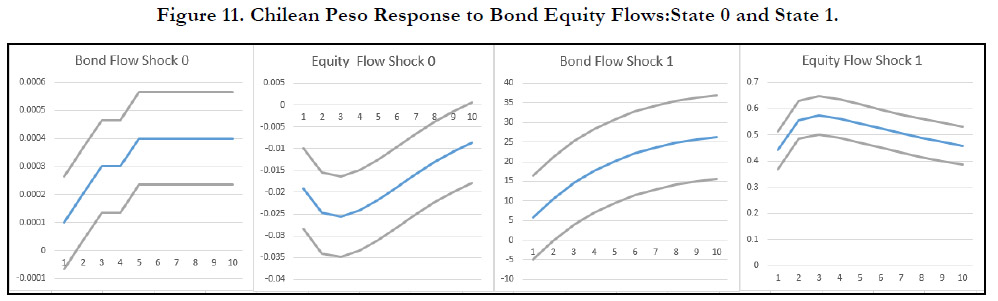

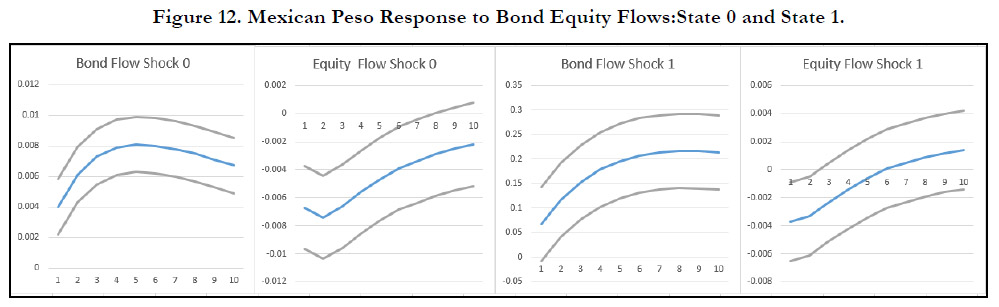

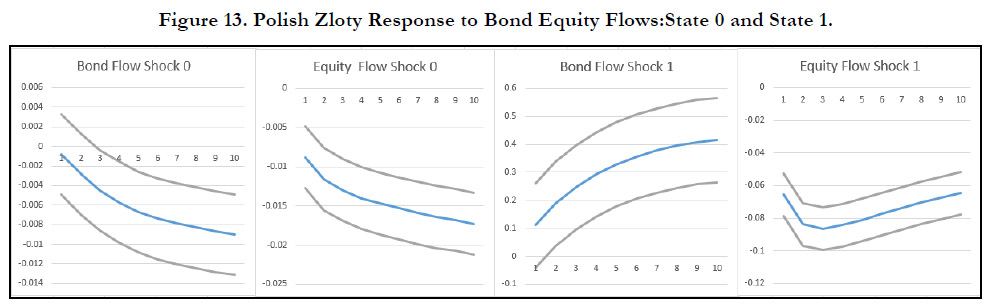

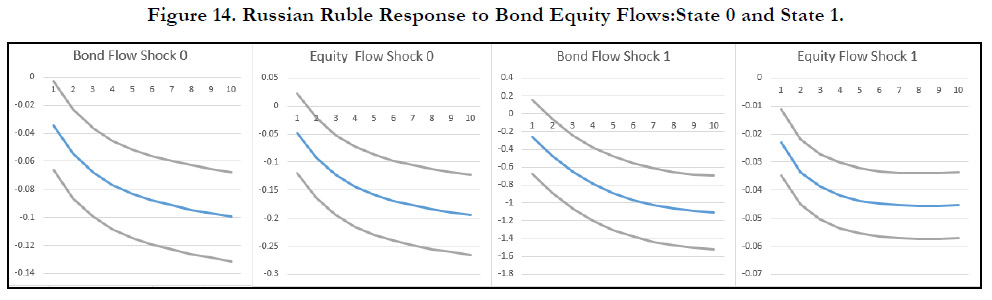

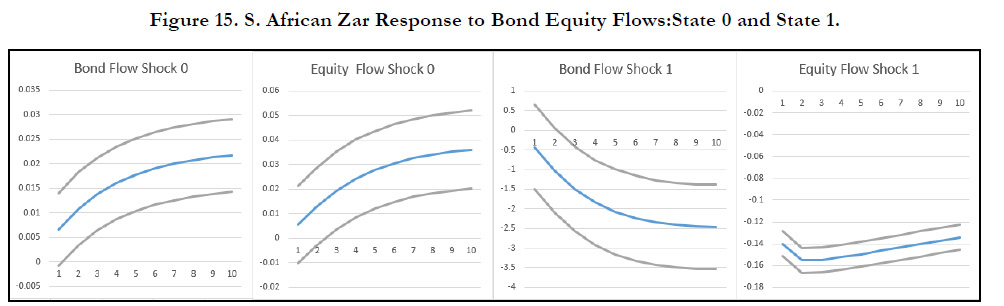

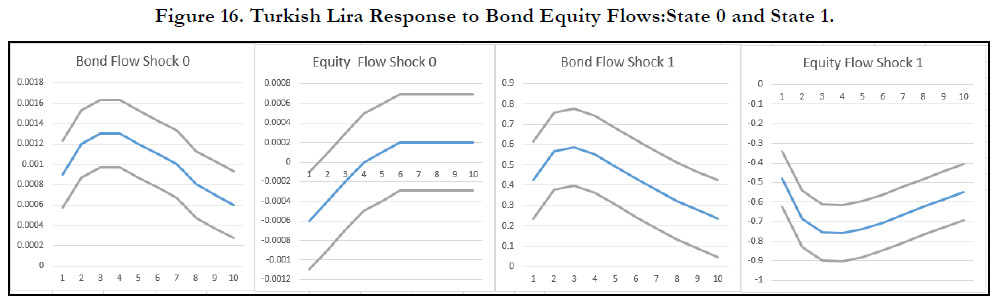

Figures 10 to Figure 16 show the response of the return of the

each currency in both states. First two graphs of each figure show

the volatility response of each currency to bond and equity positive

one standard deviation shock in State 0 and last to those of

in State 1. When one looks at the figures together, diversity of the

volatility responses of the exchange rates to the bond and equity

flows are notice- able. Bond flows permanently reduce volatility

of Brazilian real and Russian ruble in State 0, also in State I bond flows reduce volatility of Chilean peso, Russian ruble and South

African zar permanently. On the other hand, bond flows in State 0

increase volatilties of Chilean peso, Mexican peso, South African

zar, permanently and Polish zlot,Turkish lira and Mexican peso

temporarily; In State it increases volatilities of Brazilian real, Turkish

lira temporarily and Mexican peso, Polish zlot permanently.

Responses to equity flows also plot a a very heterogeneous picture

in their impact on exchange rate volatilities of emerging market

currencies.In State 0, equity flows permanently reduce the volatilities

of Brazilian real, Polish zlot and Russian ru- ble; volatilities of

Chilean and Mexican peso are temporarily reduced.On the other

hand, volatilities of Turkish lira, South African zar are permanently

increased by equity flows. In State 1, Polish zlot, Russian

ruble, Turkish lira, South African zar are permanently reduced by

equity flows;volatilities of Brazilian real and Mexican peso temporarily

reduced and Chilean peso permanently elevated. Impulse

response analysis of bond equity flows on exchange rate volatilities

of emerging market cur- rencies provide additional evidence

of heterogenous and state dependent impact of portfolio flows

on exchange rate volatilities.

According to the graphs (Figure 7), response of return of

Chilean Peso to bond flow shocks at State 0 and State 1 is

different,appreciate at State 0 and depreciate at State 1, response

of the currency to equity flows on the other hand is similar in

states appreciation.

Figure 1. Full Sample: 2004-2016, Exchange Rate-Equity Flow Standard Deviation Ratio, Exchange Rate-Bond Flow Standard Deviation Ratio.

Figure 2. Sub-Sample I: 2004-2008, Exchange Rate-Equity Flow Standard Deviation Ratio, Exchange Rate-Bond Flow Standard Deviation Ratio.

Figure 3. Sub-Sample II: 2008-2013, Exchange Rate-Equity Flow Standard Deviation Ratio, Exchange Rate-Bond Flow Standard Deviation Ratio.

Figure 4. Sub-Sample III: 2013-2019, Exchange Rate-Equity Flow Standard Deviation Ratio, Exchange Rate-Bond Flow Standard Deviation Ratio.

Figure 9. Exchange Rate Returns: Smoothed Transition Probabilities of Markov Regime Switching Model.

Conclusion

In this paper, we investigated heterogeneous effect of bond and

equity portfolio flows on volatility of emerging market currencies.

Following a two stage analysis method, we found at aggregate

level, for different periods, bond and equity flows have varying

impact on emerging market currencies together. And at individual

level, our results point a very diverse and heterogeneous impact

of portfolio flows on the volatilties of emerging markets currencies.

As a conclusion, it is hard to generalize a pattern of impact

of portfolio flows on emerging market currencies. Thus, central

bank policies on attracting foreign capital for currency stabilization

may lead to unexpected results.

Compliance with Ethical Standards: This article does not contain

any studies with human participants performed by the author.

This article does not contain any studies with animals performed

by the author. This article does not contain any studies with human

participants or animals performed by the author.

Conflict of Interest Statement: On behalf of the author, the corresponding

author states that there is no conflict of interest.

Data Availability Statement : The data that support the findings

of this study are available from the corresponding author upon

reasonable request.

Financial Support Statement: This research received no specific

grant from any funding agency in the public, commercial, or notfor-

profit sectors.

References

- Arief A, Megawati S. Analysis of factors affecting the satisfaction and loyalty of the use of cargo services: A case study of PT. BEX. Russian Journal of Agricultural and Socio-Economic Sciences. 2019;87(3).

- Arsić S, Banjević K, Nastasić A, Rošulj D, Arsić M. Family business owner as a central figure in customer relationship management. Sustainability. 2018;11(1):1-9.

- Ashraf S, Ilyas R, Imtiaz M, Ahmad S. Impact of service quality, corporate image and perceived value on brand loyalty with presence and absence of customer satisfaction: A study of four service sectors of Pakistan. International Journal of Academic Research in Business and Social Sciences. 2018;8(2):452-74.

- Stenley B. Customer Relationship Management: a strategic imperative in the world of e–business. Willey; 2000.

- Colicev A, Malshe A, Pauwels K, O'Connor P. Improving consumer mindset metrics and shareholder value through social media: The different roles of owned and earned media. Journal of Marketing. 2018 Jan;82(1):37-56.

- Dzikowski P. A bibliometric analysis of born global firms. Journal of Business Research. 2018 Apr 1;85:281-94.

- Fidel P, Schlesinger W, Emilo E. Effects of customer knowledge management and customer orientation on innovation capacity and marketing results in SMES: the mediating role of innovation orientation. International Journal of Innovation Management. 2018 Oct 5; 22(07): 26-55.

- Fossen BL, Schweidel DA. Measuring the impact of product placement with brand-related social media conversations and website traffic. Marketing Science. 2019 May;38(3):481-99.

- Gai PJ, Klesse AK. Making recommendations more effective through framings: Impacts of user-versus item-based framings on recommendation click-throughs. Journal of Marketing. 2019 Nov;83(6):61-75.

- Gholami H, Zameri Mat Saman M, Mardani A, Streimikiene D, Sharif S, Zakuan N. Proposed analytic framework for student relationship management based on a systematic review of CRM systems literature. Sustainability. 2018 Apr;10(4):1237.

- Gholami S, Rahman MS. CRM: A conceptual framework of enablers and perspectives. Business and Management Research. 2012 Mar;1(1):96-105.

- Gil-Gomez H, Guerola-Navarro V, Oltra-Badenes R, Lozano-Quilis JA. Customer relationship management: digital transformation and sustainable business model innovation. Economic research-Ekonomska istraživanja. 2020 Jan 1;33(1):2733-50.

- Gimpel H, Kleindienst D, Nüske N, Rau D, Schmied F. The upside of data privacy–delighting customers by implementing data privacy measures. Electronic Markets. 2018 Nov;28(4):437-52.

- Grabner-Kraeuter S, Moedritscher G. Alternative approaches toward measuring CRM performance. In Sixth Research Conference on Relationship Marketing and Customer Relationship Management, Atlanta (June 9–12) 2002 Jun 9.

- Grewal L, Stephen AT. In mobile we trust: The effects of mobile versus non mobile reviews on consumer purchase intentions. Journal of Marketing Research. 2019 Oct;56(5):791-808.

- Janakiraman R, Lim JH, Rishika R. The effect of a data breach announcement on customer behavior: Evidence from a multichannel retailer. Journal of Marketing. 2018 Mar;82(2):85-105.

- Jham V, Khan KM. Customer satisfaction in the Indian banking sector: A study. IIMB Management Review. 2008 Mar;20(1):84-93.

- Kebede AM, Tegegne ZL. The effect of customer relationship management on bank performance: In context of commercial banks in Amhara Region, Ethiopia. Cogent Business & Management. 2018 Jan 1;5(1):1499183.

- Komba MM, Lwoga ET. Systematic Review as a Research Method in Library and Information Science. Handbook of Research on Connecting Research Methods for Information Science Research. 2020:80-94.

- Kotler P, Keller KL, Koshy A, Jha M. Marketing management(13thedition). Pearson Education. 2012.

- Krizanova A, Gajanova L, Nadanyiova M. Design of a CRM level and performance measurement model. Sustainability. 2018 Jul;10(7):1-17.

- Kumar V, Leszkiewicz A, Herbst A. Are you back for good or still shopping around? Investigating customers' repeat churn behavior. Journal of marketing research. 2018 Apr;55(2):208-25.

- Liu W, Wang Z, Zhao H. Comparative study of customer relationship management research from East Asia, North America and Europe: A bibliometric overview. Electronic Markets. 2020 Dec;30(4):735-57.

- Meire M, Hewett K, Ballings M, Kumar V, Van den Poel D. The role of marketer-generated content in customer engagement marketing. Journal of Marketing. 2019 Nov;83(6):21-42.

- Mbango P. The role of perceived value in promoting customer satisfaction: Antecedents and consequences. Cogent Social Sciences. 2019 Jan 1;5(1):1684229.

- Mylonakis J. Customer relationship management functions: A survey of Greek bank customer satisfaction perceptions. IUP Journal of Bank Management. 2009 May 1;8(2):7.

- Nguyen HT, Nguyen H, Nguyen ND, Phan AC. Determinants of customer satisfaction and loyalty in Vietnamese life-insurance setting. Sustainability. 2018 Apr;10(4):1151.

- Pawson R, Greenhalgh T, Harvey G, Walshe K. Realist review--a new method of systematic review designed for complex policy interventions. J Health Serv Res Policy. 2005 Jul;10 (1):21-34. Pubmed. PMID: 16053581.

- Petticrew M, Roberts H. Systematic reviews in the social sciences: A practical guide. 2006.

- Pohludka M, Stverkova H, Ślusarczyk B. Implementation and unification of the ERP system in a global company as a strategic decision for sustainable entrepreneurship. Sustainability. 2018 Aug;10(8): 1-16.

- Raghuvanshi R, Tripathi R. Customer relationship management as a strategic tool in the Indian banking sector: A case study of Axis Bank at Lucknow [Paper presentation]. National Conference on Emerging Challenges for Sustainable Business, Haridwar, Uttarakhand, India. 2012.

- Rahi S. Research design and methods: A systematic review of research paradigms, sampling issues and instruments development. International Journal of Economics & Management Sciences. 2017;6(2):1-5.

- Ryals L, Payne A. Customer relationship management in financial services: towards information-enabled relationship marketing. Journal of strategic marketing. 2001 Jan 1;9(1):3-27.

- Samudro A, Sumarwan U, Simanjuntak M, Yusuf E. Assessing the effects of perceived quality and perceived value on customer satisfaction. Management Science Letters. 2020;10(5):1077-84.

- Samudro A, Sumarwan U, Simanjuntak M, Yusuf EZ. How commitment, satisfaction, and cost fluctuations influence customer loyalty. Samudro, A. 2019 Jun 19:115-25.

- Howshigan S, Ragel VR. The Effectiveness of Switching Barrier on Customer Loyalty Mediated with Customer Satisfaction: Telecommunication Industry, Batticaloa. South Asian Journal of Social Studies and Economics. 2018 Nov 15:1-9.

- Sin LY, Alan CB, Yim FH. CRM: conceptualization and scale development. European Journal of marketing. 2005 Nov 1.

- Susanti V, Sumarwan U, Simanjuntak M, Yusuf EZ. Rational antecedent framework of brand satisfaction in the industrial market: Assessing rational perceived quality and rational perceived value roles. International Review of Management and Marketing. 2020;10(1):19.

- Swift RS. Accelerating customer relationships: Using CRM and relationship technologies. Prentice Hall Professional; 2001.

- Tellis GJ, MacInnis DJ, Tirunillai S, Zhang Y. What drives virality (sharing) of online digital content? The critical role of information, emotion, and brand prominence. Journal of Marketing. 2019 Jul;83(4):1-20.

- Victor L. Systematic reviewing in the social sciences: outcomes and explanation. Enquire. 2008;1(1):32-46.

- Won EJ, Oh YK, Choeh JY. Perceptual mapping based on web search queries and consumer forum comments. International Journal of Market Research. 2018 Jul;60(4):394-407.

- Zeng M, Cao H, Chen M, Li Y. User behaviour modeling, recommendations, and purchase prediction during shopping festivals. Electronic Markets. 2019 Jun;29(2):263-74.