Electronic Banking in Greece. The case of Chalkida

Papazoglou Vasiliki1*, Papathanasiou Spyros2

1 Hellenic Open University Ifestou, Chalkida, Greece.

2 National and Kapodistrian University of Athens, Sofokleous Street, Athens, Greece.

*Corresponding Author

Vasiliki Papazoglou,

Hellenic Open University Ifestou, Chalkida Greece.

Tel: 0030 6974261555

E-mail: vasiliki.pap1@gmail.com

Received: April 04, 2018; Accepted: May 25, 2018; Published: May 31, 2018

Citation: Papazoglou Vasiliki, Papathanasiou Spyros. Electronic Banking in Greece. The case of Chalkida. Int J Financ Econ Trade. 2018;2(2):18-30. doi: dx.doi.org/10.19070/2643-038X-180004

Copyright: Papazoglou Vasiliki©© 2018. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.

Abstract

In this paper, we investigate the level of penetration of electronic banking in a provincial city of Greece, Halkida. We use descriptive and inferential statistics (Pearson Chi-Square test, crosstabulation or contingency table) in order to identify the percentage of electronic banking adoption. A random sample of 100 adults were asked to fill in a questionnaire, based on previous investigations concerning internet and electronic banking (e.g. Munusamy et al., 2012 [38], Chau & Ngai 2010 [7], Durkin 2004 [11]), modified to the specific circumstances. We used the SPSS 22 (Statistical Package for Social Sciences). The results of studies show that customers under certain conditions are receptive to the adoption of electronic banking. Gender, education and the purchase of products through the Internet, affect the usage of electronic banking. Level of education and safety are the factors influencing the intention to use electronic banking. Finally, characteristics such as cost, support/service, computer knowledge and effort made, have significant impact on perceived performance regarding the usage of online banking. The findings of this paper have practical implications for the banking industry in order to understand their own customers better and improve their services.

2.Introduction

3.Literature Review

4.Methodology

5.Empirical Rsults

5.1 Usage of Electronic Banking

5.2 Intention to use Electronic Banking

6.Conclusions

7.References

Keywords

Internet; Electronic Banking; E-Banking; Strategy; Adoption; Intention.

Introduction

The evolution of technology and telecommunications prompted the development of multiple alternative networks, making electronic banking an integral part of the banking industry's strategy. Electronic banking covers a wide range of transactions, information and management. The priority of the banking sector is to highlight the developmental directions and to specify the strategy, the means and the interventions for the exploitation of the new technologies. Knowledge of the profiles, or more generally the individual characteristics of customers is useful, in many ways. Equipped with information on customers who already adopt ebanking or are likely to do so, banks will be able to identify the market segments that should be targeted. They can then introduce banking products and services that better suit the needs and wants of the customers in the segment [4]. The banking industry must adapt to the electronic era if they are to move with times and customer demands, and not be left behind [34].

Electronic banking has been extensively studied in the international literature [17, 25, 30]. Despite the advantages (Jayshree, Chavan 2013 [23], Jayawardhena & Foley 2000 [22], Siati et al., 2014 [50]), customers are still reluctant to use this alternative method and the traditional banking system is still a major practice for transactions and banking activities in many countries [9, 15, 43]. The Banking institution management should also be facilitated by the organizational and technical Infrastructure to support operations which employ new technology in electronic banking more effectively and efficiently [2, 6, 8, 13, 16, 20, 26, 42, 55].

Further analysis is particularly useful as the research field appears to be dominated by overlaps, contradictions, repetitions, but also a storm of developments and new elements. This effort is expected to clarify the dominant trends so far, and to demonstrate the research field deficits. Conclusions can be useful to Banks, both in better understanding their own customers and improving their services. Similarly, it is important for customers, as the database will constantly be kept up to date with determining these key points that will require a two-way collaboration. This information can be used as a springboard for interaction and feedback for banking, customer and state institutions, to find out what it takes to overcome obstacles in cooperation and promote mutual benefits so that electronic banking can be a primary customer choice. This survey contributes to the wider literature in the field of electronic banking by identifying such factors influencing the customer attitude towards e-banking and exploring the changes in these factors over the time. Assessing the service needs and customers’ new expectations may help the banks develop effective strategic planning for the future of e-banking as a tool for minimizing inconvenience, reducing transaction costs and saving time. Electronic banking in Greece has not yet reached the optimal user base due to many variables which influence the customers. Further investigation of factors affecting the adoption or intention to use online banking services in general, have more benefits for banks and future researchers. Additionally the outcomes of this research are useful for the banking sector in formulating effective strategic planning which will help to retain the existing ones and attract new customers.

The research problem is about the customers’ low acceptance towards e-banking adoption and the aim is to investigate the affecting factors. The primary objectives of this study are to identify the factors influencing the adoption, non adoption and perceived usefulness of e-banking. Based on their observation, we can examine interactions and correlations between e-banking and demographic and other individual elements of the respondents and the intervention to be implemented. Angelakopoulos & Mihiotis (2011) [3], focusing on the Greek banking sector, demonstrate that banks expand in electronic banking services in order to remain competitive, to keep track of technological developments and to benefit from the lower cost of e-banking transactions. The relatively low Internet usage, non-familiarity with technologically advanced devices and problems regarding security and privacy are the main factors that have a negative influence on the adoption of online banking services by customers in Greece.

The most important research questions are about e-banking services development process, customer retention under the prevailing conditions, threats, opportunities and odds of a slowing down or increasing rate of electronic banking adoption. The research hypotheses that guide this study are as follows:

Hypotheses 1: Gender, age, marital status, education, employment and the purchase of products through the Internet, affect the usage of electronic banking.

Hypotheses 2: Gender, age, marital status, education, employment, purchase of products through the Internet, security, complexity, costs, lack of awareness and the feeling that it is unnecessary affect the intention to use electronic banking.

Hypotheses 3: Computer knowledge, effort made, security, speed, cost, and support/service affect the perceived performance of electronic banking.

Quantitative research is the approach used in this study, including a questionnaire survey, based on previous investigations concerning internet and electronic banking (e.g. Chau & Ngai 2010 [7], Durkin 2004 [11] Munusamy et al., 2012 [38]), modified to the specific circumstances. Statistical encoding, processing and analyzing research data performed with SPSS version 22. Survey conducted in the period between 11/30/2015 and 01/23/2016 on a random sample of 100 people aged over 18 in city of Chalkida.

The findings of this study provide strong evidence that gender, education and the purchase of products through the Internet, affect the usage of electronic banking. Level of education and safety are the factors influencing the intention to use online banking. Finally, characteristics such as cost, support/service, computer knowledge and effort made, have significant impact on perceived performance regarding the usage of e-banking. Customers are becoming more accustomed to using or maintaining e-banking services, once they realize that it could help them to achieve their goals.

Section 2 reviews empirical studies which have investigated the factors that influence the usage, intention to use and perceived performance regarding the usage of e-banking. Section 3 describes the data collection process and research methods of the study. Section 4 addresses the results from data analysis and Section 5 focuses on the above mentioned findings which provide meaningful insights on how to relate to statistical processing, theoretical framework introduced in the literature review and the study’s practical implications.

Literature Review

The Internet is gaining popularity as a delivery channel in the banking sector. Ιt renders location & time irrelevant, and empowers customers with greater control of their accounts. Banks achieve cost and efficiency gains in a large number of operational areas [22].

Several studies have been conducted so as to understand the role of demographic and individual features on customer behavior towards online banking. Chau & Ngai (2010) [7] find that young people have a more positive attitude and intention of using ebanking than other user-groups. Mattila et al., (2003) [31] indicate that household income and education were found to have a significant effect on the adoption of internet banking. Motwani & Shrimali, 2014 [35] conclude that gender and age are important factors while income & education differences have no impact on the usage of e-banking. Age and education are significant factors for acceptance [57]. Munusamy et al., (2012) [38] reveal that while the hypotheses pertaining to gender, race, income, educational level and occupation were not supported, the age is. Hishamuddin et al., (2009) [19] show that the demographic variables do not have any significant impact on the customer retention of the internet banking services. The demographic variables such as gender, age, qualifications and income, play a positive role in the adoption of banking technology [53]. Significant moderating factors are gender, educational level, income, internet experience but not age [20]. Patsiotis et al., (2012) [41] suggest that the policy-makers should emphasize usefulness attributes of computer-based innovations when attempting to increase the use of the Internet for banking by people who already use the Internet for shopping. High levels of internet usage at work are seen to positively influence e-banking registration [11]. Sharma & Singh (2011) [48] identify the limited e-skills among the seven factors influencing Internet banking. Perceived difficulty in using computers and the lack of personal service were found to be the main barriers of ebanking adoption [31]. Metwally (2013) [32] show that computer and Internet use experience, is one of the external factors which affected bank customers’ decision to use Internet banking.

Regarding the effects of e-banking service quality on customers, Jaruwachirathanakul & Fink (2005) [20] consider that features of the web site and perceived usefulness are the attitudinal factors that appear to encourage most the adoption of internet banking. Website quality, e-trust, e-satisfaction, corporate image, product information and perceived security significantly affect the e-loyalty of the customers [44]. Metwally (2013) [32] show that the main factor which affected bank customer decision to use Internet banking service, was ease of use, usefulness, trust and credibility of the service and some external factors such as personal innovativeness, individual differences, promoting circumstances, service assistance and communication. Perceived usefulness, ease of use, security and privacy have a significant influence on acceptance and adoption of the internet banking [37]. Keffala (2010) [24] reveal that, on one hand perceived ease of use and usefulness, trust and security are motivating factors and on the other hand, perceived costs and personal features are inhibiting factors to the adoption and usage of Internet banking. According to Sohail & Shaikh (2009) [51] efficiency, system availability, fulfillment, privacy and responsiveness are significant determinants of loyalty to internet banking users. Wu et al., (2010) [56] show that relative advantages, trust and perceived ease of use are more important and critical to customer’s intension of e-banking adoption. Dutta & Makkar (2008) [12] observe that the sought after benefits encouragement, ease and accuracy, convenience and control, lifestyle and social factors and bank reputation were the five most important factors. On the other hand, factors such as lack of knowledge and trust, security and privacy issues and the lack of training and incentives were found to act as major inhibitors in Internet banking adoption. Furthermore, Bultum (2012) [6] also identifies perceived ease and usefulness as a driver of adopting E-banking system. Lee (2009) [28] indicates that the intention to use online banking is positively affected mainly by perceived benefit, attitude and perceived usefulness.

Many factors may impact the adoption and acceptance of electronic banking services including characteristics of each county, legal and regulatory framework, security issues, reliability, usability cost, speed and support considerations. Sathye (1999) [47] shows that security concerns and lack of awareness on internet banking and its benefits stand out as being the obstacles to the adoption of Internet banking. Though there are many advantages in using internet banking, the barricades in practicing it by the clientele residing in the semi urban areas are cost, lack of infrastructure, traditional banking, unfriendly web site, unawareness and reluctance to change [43]. Gerrard et al., (2006) [14], identify eight factors which explain why customers are not using e-banking. In order of frequency, the factors are: perceptions about risk; the need; lack of knowledge; inertia; inaccessibility; human touch; pricing and IT fatigue. Additionally other major barriers are security risk and lack of trust, ICT infrastructure, legal and regulatory framework [6]. However, further improvements on security and provision of key ingredients of e-banking which includes confidentiality, effective communication integrity and availability, should be considered in order to satisfy customers’ requirements [8]. The intention to use online banking is adversely affected mainly by the security/ privacy risk, as well as financial risk [28]. According to Alim Al Ayub & Nur-E-Alam (2013) [1] perceptions of risk, lack of adequate support and training from banking institutions are some of the causes of non-usage. However, the cumbersome process of setting up an internet account discourages many, and the difficult process of correcting problems reduces usage even among some who use the internet for transactions [27].

Finally, there is a type of customer who prefers the traditional banks for many reasons, such as human interaction, virtual contact reservations or the importance of their transactions. Giordani et al. (2014) [15], report that branch dissatisfaction and high branch fees have no impact on the internet banking adoption in Greece, therefore Greek customers prefer to visit branches and are willing to pay high fees for the transactions. Larpsiri et al. (2002) [27], suggest that while security is a major factor inhibiting wider adoption, it is not necessarily the key distinguishing factor in “who will adopt” versus “who will not”. Users seem to be more time and cost conscious, and especially value convenience. Non-users are much more service conscious, and do not like the self-service of the internet. Mattila et al. (2003) [31] and Sharma & Singh (2011) [48], report that the lack of personal service in e-banking was found to be among the main barriers of Internet banking adoption.

Methodology

This research uses quantitative method. However, this survey focuses on the factors influencing the adoption and acceptance of e-banking. The factors considered in our analysis include demographic and individual characteristics (Munusamy et al., 2012 [38], Chau & Ngai 2010 [7], Motwani & Shrimali 2014 [35], Tater et al. 2011 [53]), purchase of products through the Internet (Durkin 2004 [11], Patsiotis et al., 2012) [41], effort made, security, speed, cost, support/service [14, 27, 29, 33, 46, 56]. The dependent variable is the usage (Sohail & Shaikh 2009 [51], Mukherjee & Nath 2003 [36], Raitani & Vyas 2014 [44], Sharma & Singh 2011) [48], the intention to use (Shirodkar 2015 [49], Dumičić et al. 2014 [10], Suh & Han 2003 [52], Sathye 1999 [47], Dutta & Makkar 2008 [12]) and perceived performance regarding the usage of ebanking [24, 28, 37, 45, 57].

The survey was conducted from 11/30/2015 to 01/23/2016. A random sample of 100 adults asked to reply to a questionnaire, based on previous investigations concerning the internet and electronic banking (e.g. Munusamy et al., 2012 [38], Chau & Ngai 2010 [7], Durkin 2004 [11]), modified to the specific circumstances. Respondents filled in the questionnaires themselves 59%, (through 3 relative-owned shops in central spots), 9% by phone and 32% by email. Furthermore, telephone and email response was completely positive (friends and relatives). Of the 100 adults who participate in the random sample, 31 are women and 69 men. The ages are 12% (18-24), 21% (25-34), 33% (35-44), 19% (45-54), 8% (55-64) και 7% (over 65 years old). The marital status is 57% married, 35% single, 3% divorced and 5% widowed. The educational level is 44% Highest, 45% Average and 11% Basic. Employment is shared by 55% Employed, 19% Self-employed, 15% Unemployed, 9% Pensioners and 2% Other (students).

Among the 100 valid responses, 57% are users and 43% non users of electronic banking. What follows are some main points of our sample that should receive careful attention.

1. 38% percent of the respondents prefers human contact, which was expected because of the low usage rate of internet banking in Greek society.

2. The usage of ATM is significantly dominated by 65% percent of the respondents. Incomplete information may be responsible for not using other forms of e-banking. The same question among the users, is 57.9 percent while the usage of web is 64.9%.

3. Clients overwhelmingly cooperate with systemic banks which is attributed to the sense of security, but also to synergies and co-operations / incentives and payroll packages.

4. 65% percent of the respondents refers purchase of products through the Internet. This is a potential group for the implementation of e-banking because of the existing trend of people who already use the Internet for shopping.

5. The imposition of capital controls in Greece caused e-banking to explode (29.8% adopted e-banking during 2015 and 71.9% intensified the usage). It can also help create the conditions required for the preservation of this occasional usage with concerted actions by Banking Institutions.

6. 50.9 percent of the users report above-average computer skills. Seeking optimization is necessary to satisfy the increasing demands of this group.

7. Account information, payments and transfers are among the most popular e-banking transactions. An appropriate promotional banking action could be created to extend the transactions via e-banking.

8. 45.6% percent of the users refer perceived efficiency below averages and 49.1% made effort above average regarding the performance of online banking transactions. These are indications that the banks should take action to facilitate and enhance users, such as easier and more user-friendly site, more information, support, simplification and even more.

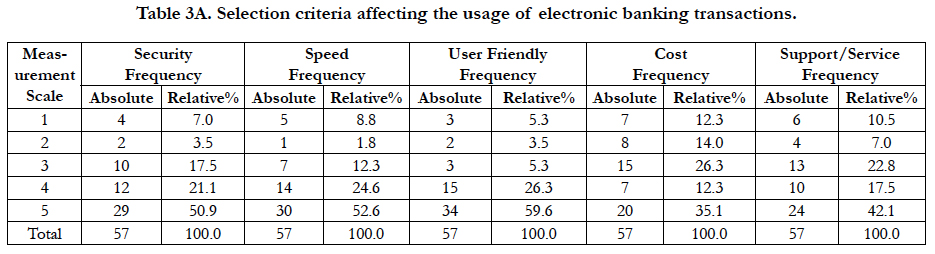

9. The distinct factors that determine the customers’ e-bank selection criteria, in descending order of importance , are user friendly, speed, security, support/service and cost (Table 3A).

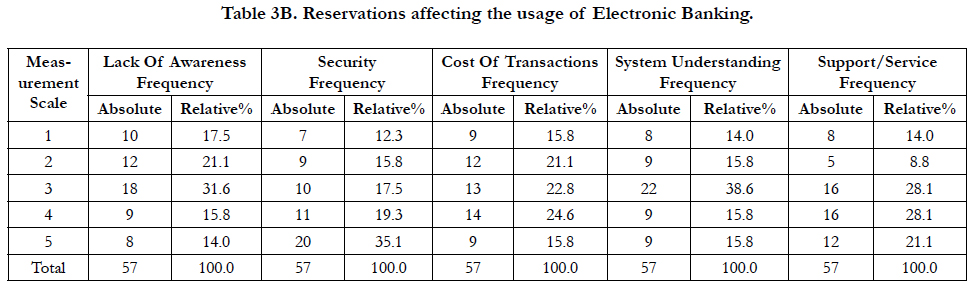

10. The distinct factors that determine the customers’ bank reservations in the online banking sector in descending order of importance are (a) below average, lack of awareness, system understanding, cost, support/service and security and (b) above average, security, support/service, cost, system understanding and lack of awareness (Table 3B).

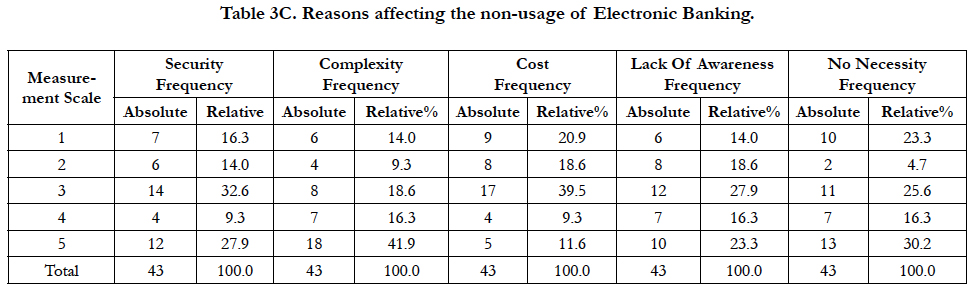

11. The distinct factors that determine the customers’ e-bank non usage reasons in descending order of importance are (a) below average, cost, security, lack of awareness, no necessity and complexity (b) above average, complexity, no necessity, lack of awareness, security, and cost (Table 3C). The intention rate for using electronic banking has reached the level of 58.1%.

The collection of the data accomplished, by using as research tool a questionnaire, based on previous surveys (Munusamy et al. 2012 [38], Chau & Ngai 2010 [7], Durkin 2004 [11], Wu et al. 2010 [56], Saibaba 2014 [46], Sohail & Shaikh 2009 [51], Raitani & Vyas 2014 [44], Shirodkar 2015 [49], Dumičić et al., 2014 [10], Rashidi & Mansoori 2015 [45], Lee 2009 [28], Zarafat et al., 2013 [57], Munasinghe 2014 [37]) regarding internet and electronic banking and modified to the specific circumstances. While questionnaires are usually viewed as a more objective research tool that can produce general results because of large sample sizes, results can be threatened by many factors including: faulty questionnaire design; sampling and non-response errors; biased questionnaire design and wording; respondent unreliability, ignorance, misunderstanding, reticence, or bias; errors in coding, processing, and statistical analysis; and faulty interpretation of results [40]. Additionally, questionnaire research can be seen as over-reliant on instruments and, thus be disconnected from everyday life, with measurement processes creating a spurious or artificial sense of accuracy [5]. The questionnaire distributed and formulated with questions, corresponds to the special needs of research according to Javeau’s principals (2000) in order to be accessible and easy to use whilst the clear instructions contribute to the validity of the research.

Standardize Information Gathering is an efficient way of collecting information from a large number of respondents. The responses were gathered in a standardized way, so the used questionnaire consisted mainly of closed-ended questions such as dichotomous choice, multiple choices, rank ordering, ticking one or more applicable items on a checklist. Personal information was collected anonymously to help ensure the objectivity, integrity and validity of the research.

Analyses performed using Statistical Package IBM SPSS 22. We use descriptive and inferential statistics (Chi-Square test, crosstabulation or contingency table). Contingency tables are used to examine the relationship between two categorical variables. Depending on the differences between the observed and expected counts, we can conclude a relationship or not, between the two variables. Then, chi-square test (Todd et al., 2011) [54] is applied to compare the variables in the contingency tables. It is considered as an appropriate statistical test for comparison between two nominal variables. The significance level is set at a=0.05. If the p-value is greater than a, the null hypothesis can’t be rejected (depended variables). Basic rules: no expected counts less than 5 and no expected counts less than 1 and 25% of counts no less than 5.

Empirical Rsults

For each research hypothesis, descriptive and inferential statistics were used. The results are as follows.

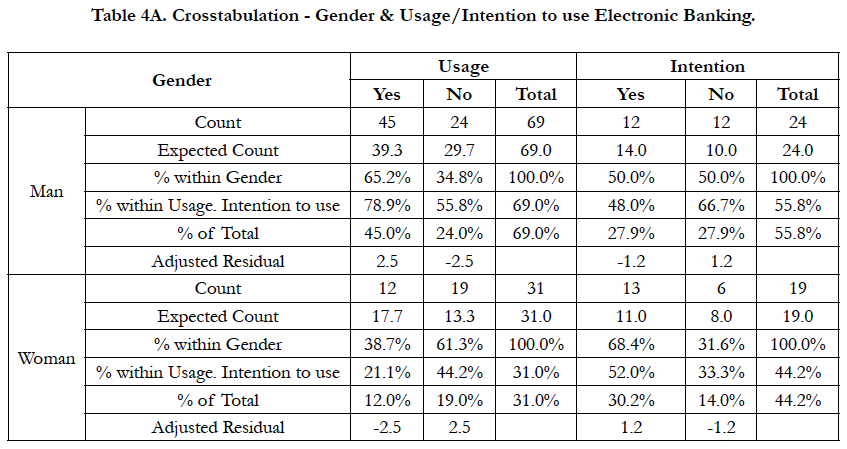

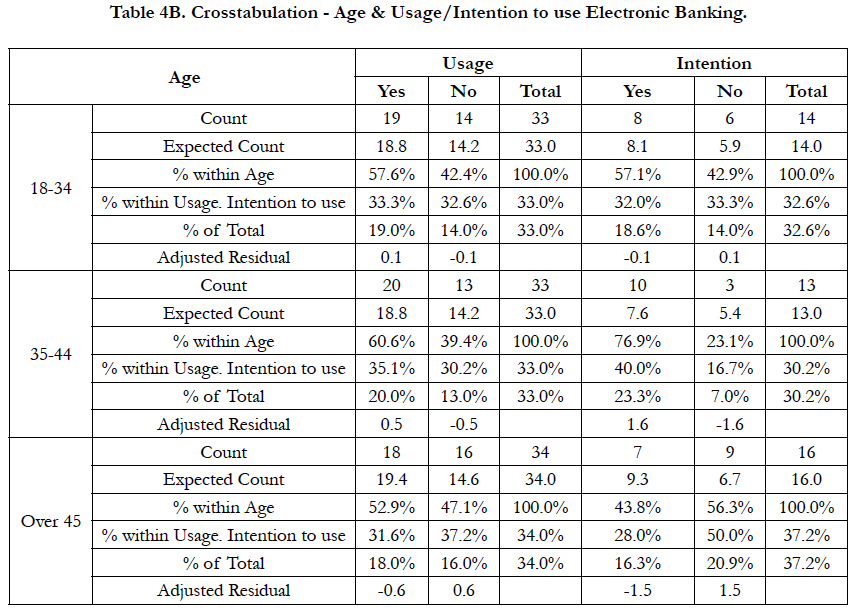

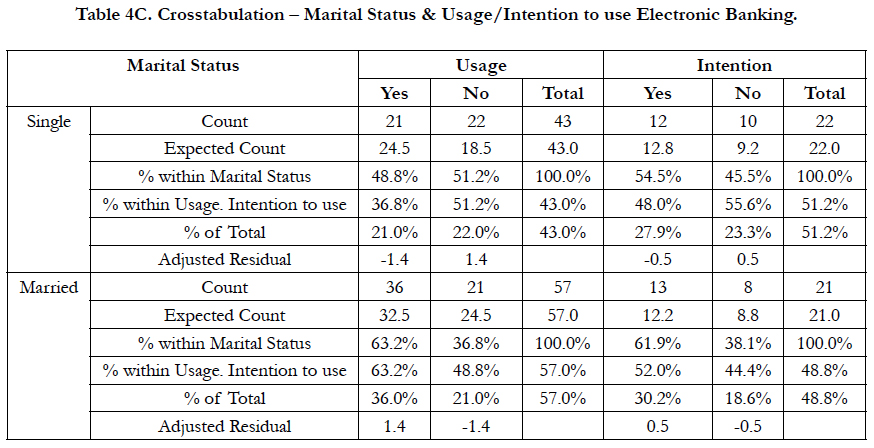

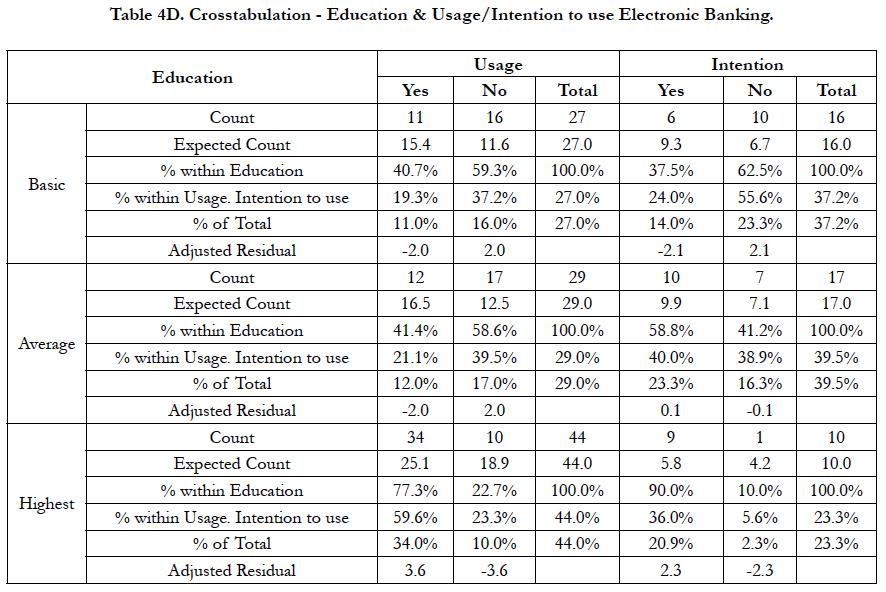

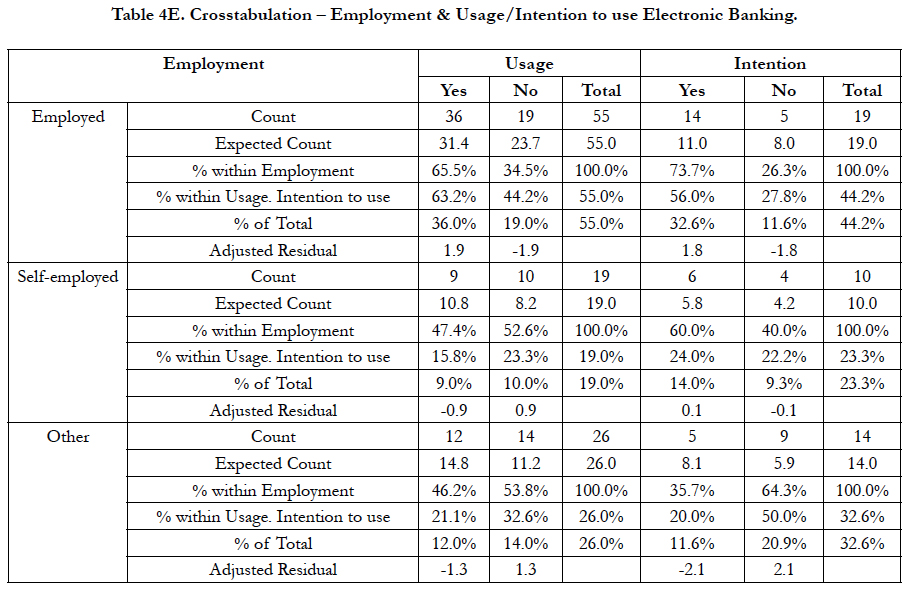

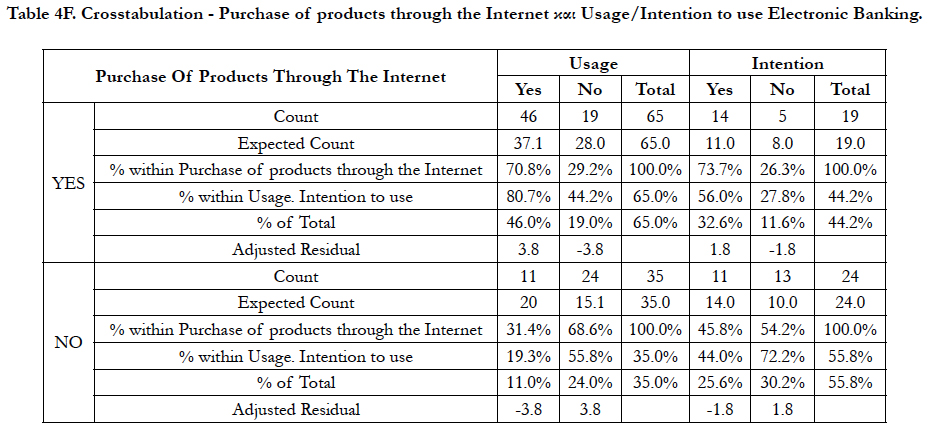

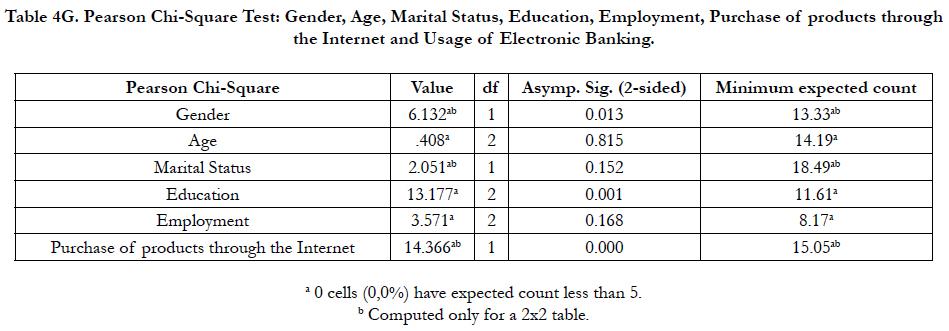

The contingency tables’ cells regarding gender (Table 4A), education (Table 4D) and the purchase of products through the Internet (Table 4F) have large discrepancies between the observed and expected counts. Also the adjusted residuals are above the absolute value 1.96 [> |±1.96|]. These results provide a preliminary indication that the categorical variables aren’t independent. In the same way, when considering the age (Table 4B), marital status (Table 4C) and employment (Table 4E) the differences between the observed and expected counts combined with the fact that none of the adjusted residuals values aren’t above the absolute value 1.96 [> |±1.96|] provide a preliminary indication that the categorical variables are independent. These indications are confirmed by the chi-square Table 4G which shows that gender (x2 0.013 < 0.05) education (x2 0.001 < 0.05) and the purchase of products through the Internet (x2 0.000 < 0.05) affect the usage, while age (x2 0.815 > 0.05), marital status (x2 0.152 > 0.05) and employment (x2 0.168 > 0.05) have no significant influence on usage behavior of e-banking users.

Table 4F. Crosstabulation - Purchase of products through the Internet και Usage/Intention to use Electronic Banking.

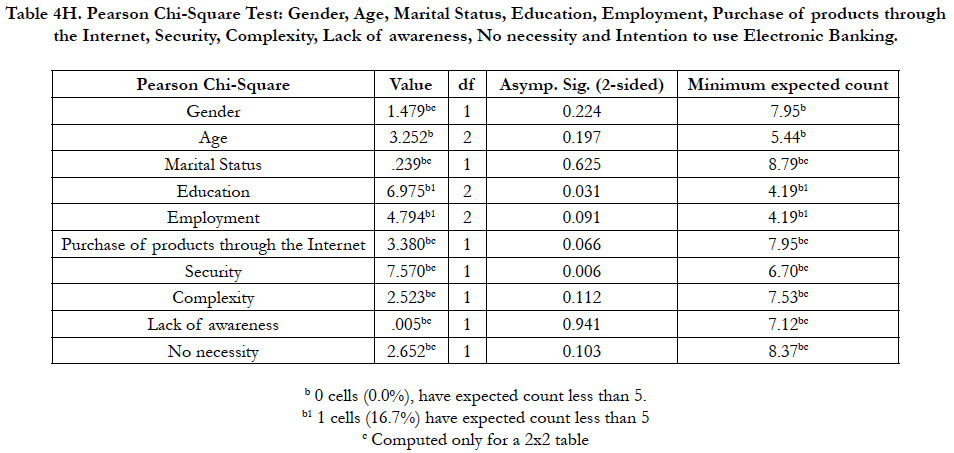

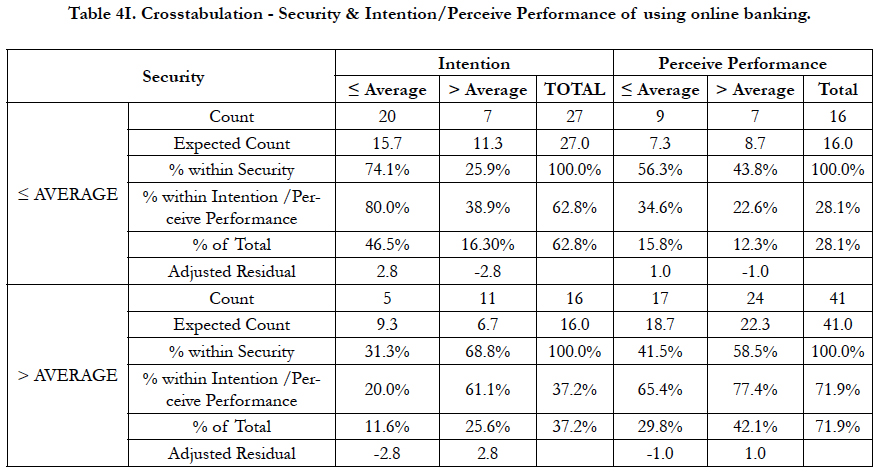

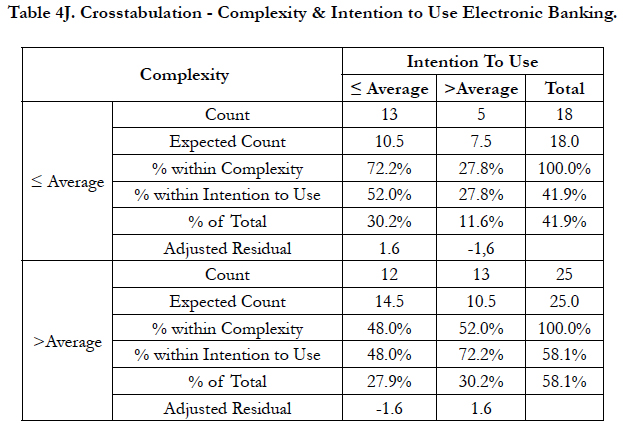

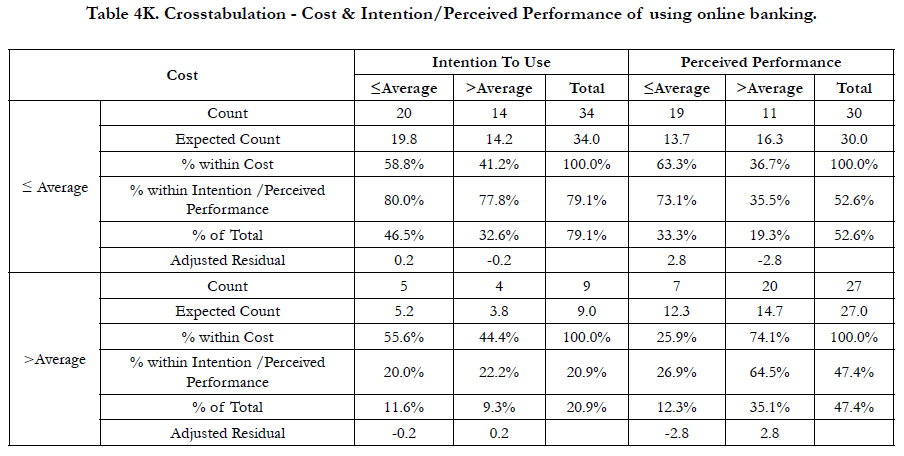

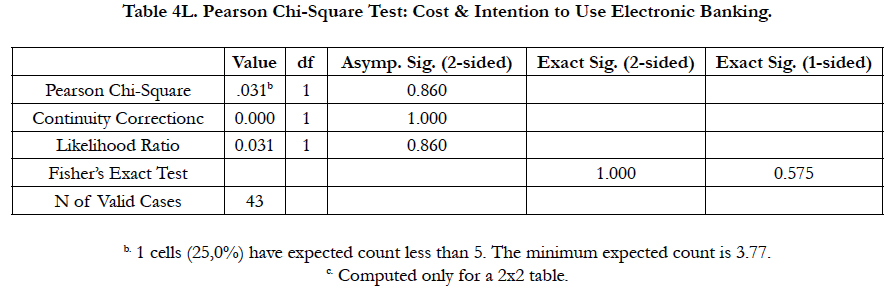

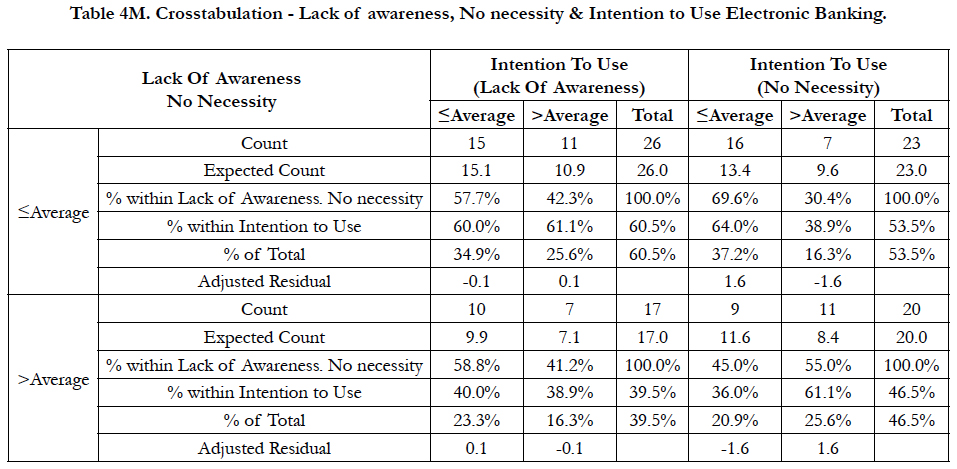

The discrepancies between the observed and expected counts on the contingency tables regarding the education (Table 4D) and security (Table 4I) combined with the majority of the adjusted residuals which are above the absolute value 1.96 [> |±1.96|] provide a preliminary indication that the categorical variables aren’t independent. In the same way, when considering the gender (Table 4A) age (Table 4B), marital status (Table 4C) employment (Table 4E) purchase of products through the Internet (Table 4F) complexity (Table 4J) cost (Table 4K) lack of awareness (Table 4M) and no necessity (Table 4M) the differences between the observed and expected counts combined with the fact that none, of the adjusted residual values aren’t above the absolute value 1.96 [> |±1.96|] provide a preliminary indication that the categorical variables are independent. These indications are confirmed by the chi-square Table 4H which shows that education (x2 0.031< 0.05) and security (x2 0.006 < 0.05) affect the intention of usage while gender (x2 0.224 >0.05) age (x2 0.197 > 0.05), marital status (x2 0.625 > 0.05), employment (x2 0.091 > 0.05), purchase products through the Internet (x2 0.066 >0.05), complexity (x2 0.112 > 0.05), lack of awareness (x2 0.941 > 0.05), no necessity (x2 0.103 > 0.05) have no significant influence on the intention of using e-banking services. In the same way the Table 4L shows that cost (Fisher’s test: 0.575 > 0.05) has no significant influence on the intention of using online banking.

Taking into account the above-mentioned notes we can use the Fisher’s exact test (p-value 0.575 > 0.05) and draw a conclusion that cost hasn’t significant influence on the intention to use electronic banking.

Table 4G. Pearson Chi-Square Test: Gender, Age, Marital Status, Education, Employment, Purchase of products through the Internet and Usage of Electronic Banking.

Table 4H. Pearson Chi-Square Test: Gender, Age, Marital Status, Education, Employment, Purchase of products through the Internet, Security, Complexity, Lack of awareness, No necessity and Intention to use Electronic Banking.

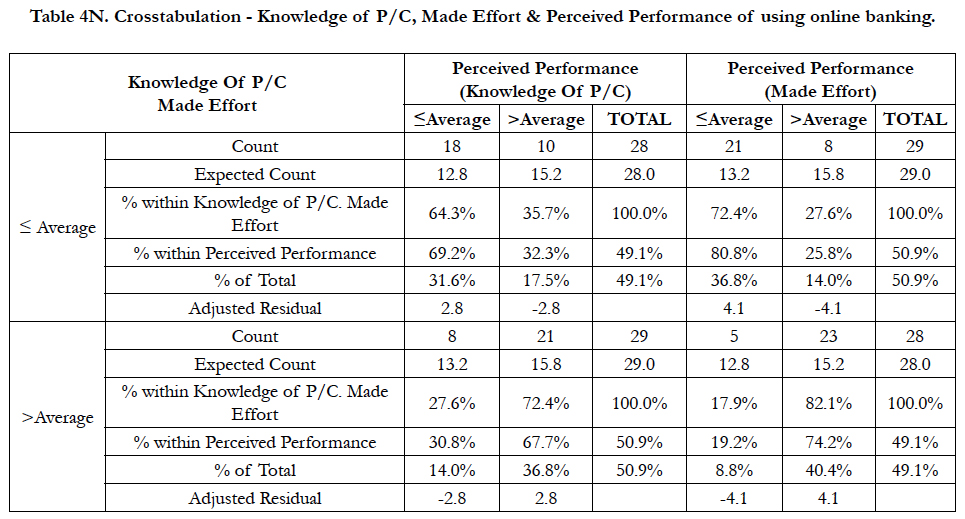

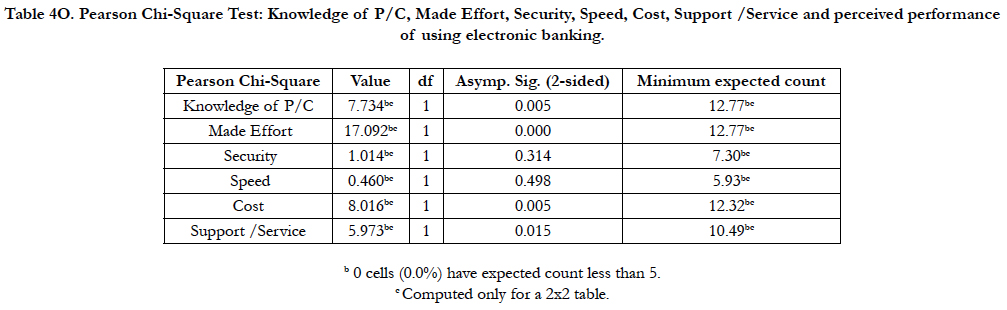

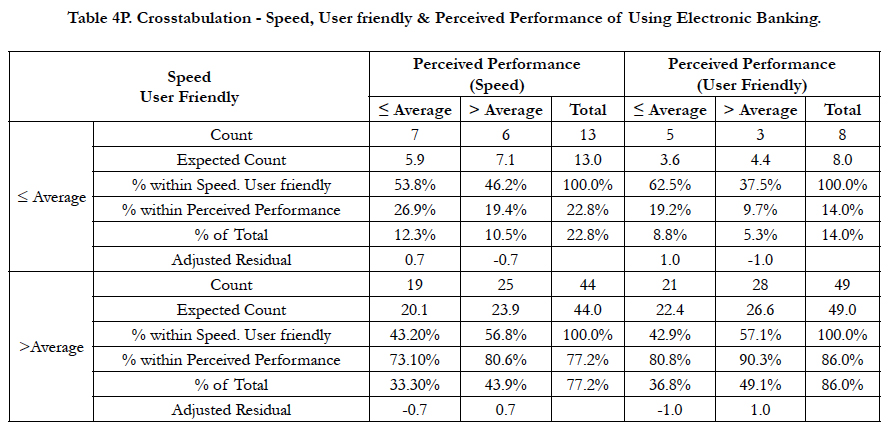

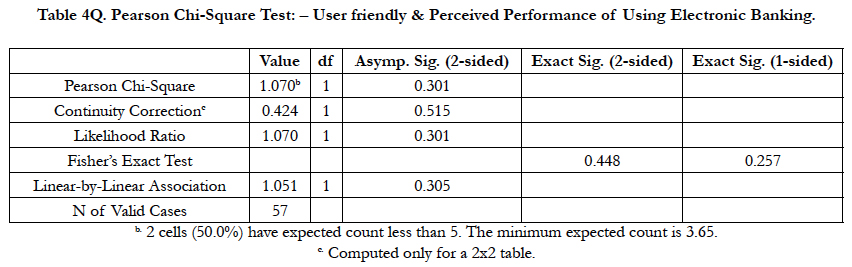

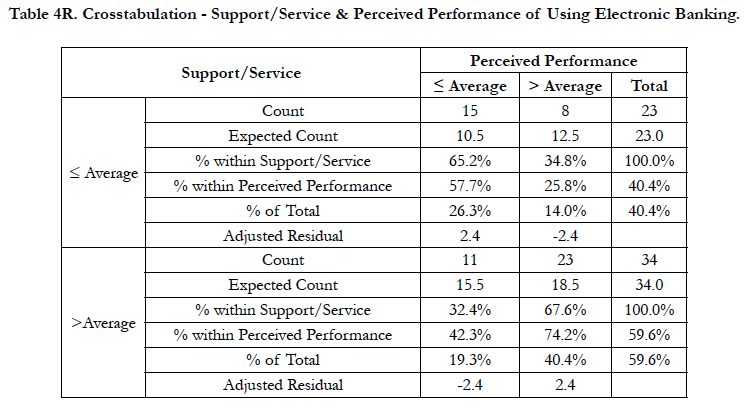

Perceived performance of using e-banking services: The contingency tables’ cells regarding knowledge of P/C (Table 4N), made effort (Table 4N), cost (Table 4K) and support/service (Table 4R) have large discrepancies between the observed and expected counts. Also the adjusted residuals are above the absolute value 1.96 [> |±1.96|]. These results provide a preliminary indication that the categorical variables aren’t independent. In the same way, when considering the security (Table 4I), speed (Table 4P) and user friendly (Table 4P) the differences between the observed and expected counts combined with the fact that none, of the adjusted residual values aren’t above the absolute value 1.96 [> |±1.96|] provide a preliminary indication that the categorical variables are independent. These indications are confirmed by the chi-square Table 4O which shows that knowledge of P/C (x2 0.005 < 0.05), made effort (x2 0.000 < 0.05), cost (x2 0.005 < 0.05) and support/service (x2 0.015 < 0.05) have significant influence on the perceived performance while security (x2 0.314 > 0.05) and speed (x2 0.498 > 0.05) have no significant influence on the perceived performance of using e-banking services. In the same way Table 4Q shows that user friendly ((Fisher’s test: 0.257 >0.05) has no significant influence on the perceived performance of using e-banking.

Table 4N. Crosstabulation - Knowledge of P/C, Made Effort & Perceived Performance of using online banking.

Table 4O. Pearson Chi-Square Test: Knowledge of P/C, Made Effort, Security, Speed, Cost, Support /Service and perceived performance of using electronic banking.

Table 4P. Crosstabulation - Speed, User friendly & Perceived Performance of Using Electronic Banking.

Table 4Q. Pearson Chi-Square Test: – User friendly & Perceived Performance of Using Electronic Banking.

Taking into account the above-mentioned notes we can use the Fisher’s exact test (p-value 0.257 > 0.05) and draw a conclusion that easy to use hasn’t significant influence on the perceived performance of using electronic banking.

Conclusions

The findings lead to a strong need for two-way communication between customers and banks in the context of mutually beneficial cooperation. Primarily the banks must take the necessary measures to ensure unobstructed line access and a secure environment for e-banking customers. At the same time, the conscious and active participation of users can play a major role in developing a secure, modern and user-friendly framework of electronic banking.

The data analyzed by using (a) descriptive statistics to describe the basic features of the data and provide simple summaries about the sample and observations that have been made and (b) inferential statistics to examine the relationship between variables and make inferences from our data to more general conditions. A variable is a value which can change depending on conditions. The variables used in this survey are qualitative. To facilitate the interpretation and analysis of survey results, data was organized and presented in the form of tables and charts. A contingency table analysis was used to examine the relationship between two categorical variables and was accomplished using a chi-square statistic that compares the observed counts with those that would be expected if there were no association between the two variables. However the sampling error must be taken into account when it is an important source of variation and comprises the differences between the sample and the population. In financial terms, the economic advantage of using a sample in research, is that taking a sample requires fewer resources than a census.

This survey tries to contribute to the larger literature in the field of electronic banking. The generalization from the findings relies on the existing literature to support the deduction or hypotheses arising from this survey. The research questions have been addressed by comparing the results with those reported previously in order to show how the findings reflect, contradict or extend previous research literature. The obtained result can be summarized as follows:

Usage of electronic banking: Gender, education and purchase products through the Internet affect the usage while age, marital status and employment have no significant influence on the usage of e-banking services. The comparison between the findings of this study and previous research results, shows that they are differentiated (Hishamuddin et al., 2009 [19], Chau & Ngai 2010 [7]) or identical ((Metwally 2013 [32], Sharma & Singh 2011 [48], Patsiotis et al., 2012 [41]) or partially agreeable [35, 57].

Intention to use online banking: Education and safety affect the intention while gender, age, employment, marital status, purchase products through Internet, complexity, cost, no necessity and lack of awareness have no significant influence on the intention of using e-banking services. The comparison between the findings of this study and previous research results, shows that they are differentiated (Premalatha et al. 2014 [43], Keffala 2010 [24], Wu et al., 2010 [56], Dutta & Makkar 2008 [12]), or identical (Gerrard et al., 2006 [14], Bultum 2012 [6], Chiemeke 2006 [8], Lee 2009 [28], Munasinghe 2014 [37]), Keffala 2010 [24], Dutta & Makkar 2008 [12], Giordani et al., 2014 [15], Alim Al Ayub & Nur-E-Alam 2013 [1], Durkin 2004 [11] or partially agreeable [20, 27, 31, 38, 47, 53].

Perceived performance of using electronic banking: Cost, knowledge of P/C, support/service, and effort made, affect the perceived performance while safety, speed and user friendly have no significant influence on the perceived performance of using ebanking services. The comparison between the findings of this study and previous research results shows that they are differentiated (Raitani & Vyas 2014) [44], or identical (Munasinghe 2014 [37], Keffala 2010 [24], Metwally 2013 [32], Bultum 2012 [6]) or partially agreeable [51].

Statistical processing and comparative approach literature by contrasting findings with multiple previous research results, demonstrate both the importance and timeliness of the factors influencing the adoption of e-banking and emerging Information and Communication Technologies. One point of concern has arisen with regard to how much the required actions have been undertaken in order to stimulate electronic banking growth and maintain expected e-banking services usage levels.

Another important point to mention is that under extraordinary conditions such as capital controls, many barriers and reservations are left out and the usage and registration of new customers is intensified. This fact alone cannot guarantee the users’ duration and dedication unless the customers’ required conditions are fulfilled at the same time. Banks should make their customers feel that e-banking will be more useful or user friendly, more trustworthy and less risky [46]. The impact of e-banking on cost savings, revenue growth and increased customer satisfaction on Industry is tremendous and can be a potential tool for building a sound strategy [18]. Current technology allows for secure site design. It is up to the development team to be both proactive and reactive in handling security threats, and up to the consumer to be vigilant when doing business online [39]. Trust is examined as the important factor of Internet banking adoption (Suh & Han, 2003) [52] and future commitment of the customers to online banking depends on perceived trust [36]. The future of the banking sector for staying competitive in the current financial environment will depend on its ability to be part of the wide world Web. The challenge for banking policymakers is to maximize the benefits of electronic banking while minimizing risk and threats by using Information and Communication Technology.

References

- Ahmed A, Siddique M. Internet Banking Espousal in Bangladesh: A Probing Study. Eng Int. 2013;1(2),40-47.

- Fatima A. E-Banking Security Issues. Is There A Solution in Biometrics?. JIBC. 2011 Jan 1;16(2):1-9.

- Angelakopoulos G, Mihiotis A. E-banking: challenges and opportunities in the Greek banking sector. IJEC. 2011 Sep 1;11(3):297-319.

- Sanmugam A. Factors determining consumer adoption of internet banking. Erişim Tarihi. 2007;13:2015.

- Bryman A. Social research methods. Oxford university press; 2008 Dec 3.

- Bultum AG. Adoption of Electronic Banking System in Ethiopian Banking Industry: Barriers and Driver. 2012.

- Sum Chau V, Ngai LW. The youth market for internet banking services: perceptions, attitude and behaviour. Int J Serv Mark. 2010 Feb 23;24(1):42-60.

- Chiemeke SC, Evwiekpaefe AE, Chete FO. The adoption of Internet banking in Nigeria: An empirical investigation. JIBC. 2006 Dec 1;11(3):1-10.

- Arnaboldi F, Claeys P. Internet banking in Europe: a comparative analysis. Res Inst of Appl Econ. 2008 Sep;8(11):1-28.

- Dumičić K, Časni AČ, Palić I. Multivariate analysis of determinants of Internet banking use in European Union countries. Cent Eur J Oper Res. 2014 Sep 1;23(3):563-78.

- Durkin M. In search of the internet-banking customer: exploring the use of decision styles. Int J Bank Mark. 2004 Dec 1;22(7):484-503.

- Dutta K, Makkar U. Attributes affecting the growth of online banking: a consumer perspective. Int J Tech Mark. 2008 Jan 1;3(4):376-91.

- Fekadu GW. Electronic Banking in Ethiopia: Practices, Opportunites and Challenges. 2009.

- Gerrard P, Barton Cunningham J, Devlin JF. Why consumers are not using internet banking: a qualitative study. J Serv Mark. 2006 Apr 1;20(3):160-8.

- Giordani G, Floros C, Judge G. Econometric investigation of internet banking adoption in Greece. J Econ Stud. 2014 Jul 8;41(4):586-600.

- Kim Goh KH, Kauffman RJ. Firm Strategy and the Internet in American Commercial Banking. 2013.

- Goudarzi S, Hassan WH, Baee MA, Soleymani SA. The Model of Customer Trust for Internet Banking Adoption. InComputational Intelligence and Efficiency in Engineering Systems. 2015.

- Gupta PK. Internet banking in India–Consumer concerns and bank strategies. Browser Download This Paper. 2008.

- Ismail HB, Panni MF. Factors affecting customer retention toward internet banking in Malaysia. Journal of Information & Knowledge Management. 2009 Mar;8(01):35-43.

- Jaruwachirathanakul B, Fink D. Internet banking adoption strategies for a developing country: the case of Thailand. Internet Res. 2005 Jul 1;15(3):295-311.

- Javeau C. The research with questionnaire. The Handbook of Good Researcher, Athens, Typothito. 1996.

- Jayawardhena C, Foley P. Changes in the banking sector–the case of Internet banking in the UK. Internet Res. 2000 Mar 1;10(1):19-31.

- Chavan J. Internet banking-Benefits and challenges in an emerging economy. Int J Res in Bus Manag. 2013 Jun;1(1):19-26.

- Keffala MR. Barriers to the Adoption and the Usage of Internet Banking by Tunisian Consumers. 2010.

- Kampakaki M, Papathanasiou S. Electronic - Banking and Customer Satisfaction in Greece. The Case of Piraeus Bank. 2016. Annals of Management Science 5 (1):55-68

- Kirakosyan K, Dănăiaţă D. Communication management in electronic banking. Better communication for better relationship. Procedia-Social and Behavioral Sciences. 2014 Mar 20;124:361-70.

- Larpsiri R, Rotchanakitumnuai S, Chaisrakeo S, Speece M. The impact of Internet banking on Thai consumer perception. 2002.

- Lee MC. Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electronic commerce research and applications. 2009 May 1;8(3):130-41.

- Sharma G, Malviya S, Dehariya N. Exploring the Dimensions of Internet Banking Service Quality in Indore. 2014.

- Guerrero MM, Egea JM, González MV. Application of the latent class regression methodology to the analysis of Internet use for banking transactions in the European Union. Journal of Business Research. 2007 Feb 1;60(2):137-45.

- Mattila M, Karjaluoto H, Pento T. Internet banking adoption among mature customers: early majority or laggards?. Journal of services marketing. 2003 Sep 1;17(5):514-28.

- Metwally EK. An assessment of users' acceptance of Internet banking: An empirical case of Egypt. American Academic & Scholarly Research Journal. 2013 Jul 1;5(5):132.

- Jun M, Cai S. The key determinants of internet banking service quality: a content analysis. Int J Bank Mark. 2001 Dec 1;19(7):276-91.

- Mobarek A. E-banking practices and customer satisfaction-a case study in botswana. 2007.

- Motwani D, Shrimali D. Consumer Behavior in Electronic Banking: An Emp Stud. 2014.

- Mukherjee A, Nath P. A model of trust in online relationship banking. Int J Bank Mark. 2003 Feb 1;21(1):5-15.

- Munasinghe PG. Technology Acceptance and Adoption: The Case of Internet Banking. 2014.

- Munusamy J, De Run E, Chelliah S, Annamalah S. Adoption of retail internet banking: A study of demographic factors. 2012.

- Omariba ZB, Masese NB, Wanyembi G. Security and privacy of electronic banking. Int J Computer Science Issues. 2012;9(4):432-46.

- Oppenheim AN. Questionnaire design, interviewing and attitude measurement. New York City: St. Martin's Press; 1992.

- Patsiotis AG, Hughes T, Webber D. Internet shopping and Internet banking in sequence. 2012 Jan 7.

- Polasik M, Piotr Wisniewski T. Empirical analysis of internet banking adoption in Poland. Int J Bank Mark. 2008 Jan 30;27(1):32-52.

- Premalatha JR, Sundaram N. Reasons for non-adoption of internet banking: A study with reference to Vellore district of Tamil Nadu, India. Asian Soc Sci. 2014 Mar 26;10(8):116.

- Raitani S, Vyas V. An exploratory study of factors influencing the e-loyalty of online banking consumers. IUP J Bank Manag. 2014 Aug 1;13(3):34.

- Rashidi E, Mansoori DE. Discussing the Effects of Internet Banking on Customer Satisfaction. 2015.

- Saibaba S. Factors Influencing Customers' Intentions to Use Internet Banking: Model Development and Test.

- Sathye M. Adoption of Internet banking by Australian consumers: an empirical investigation. Int J Bank Mark. 1999 Dec 1;17(7):324-34.

- Sharma S, Singh R. Factors influencing internet banking: an empirical investigation. IUP J Bank Manag. 2011 Nov 1;10(4):71.

- Shirodkar NG. A Comparative Analysis of Customer Perception and Operational Risks of E-Banking Products: A Study of Select Banks in Goa. IUP J Bank Manag. 2015 Aug 1;14(3):17.

- Papathanasiou S, Siati M. Emotional Intelligence and Job Satisfaction in Greek Banking Sector. 2014. 6 (1): 225-239.

- Sohail MS, Shaikh NM. The impact of electronic service quality in creating customer value and loyalty. Journal for Global Business Advancement. 2009 Jan 1;2(3):221-36.

- Suh B, Han I. Effect of trust on customer acceptance of Internet banking. Electron Commer Res Appl. 2003 Sep 1;1(3-4):247-63.

- Tater B, Tanwar M, Murari K. Customer adoption of banking technology in private banks of India. 2011.

- Franke TM, Ho T, Christie CA. The chi-square test: Often used and more often misinterpreted. Am J Eval. 2012 Sep;33(3):448-58.

- Vong J, Mandal P, Song I. Digital Banking for Alleviating Rural Poverty in Indonesia: Some Evidences. InSmart Technologies for Smart Nations. 2016:3-18.

- Wu HY, Lin CC, Li O, Lin HH. A study of bank customers’ perceived usefulness of adopting online banking. 2011.

- Zarafat H, Pahlevan Sharif S, Ming CW. Demographic and social differences in the acceptance of Internet banking: An empirical study of Malaysia. 2013.