Bank Mergers - Takeovers and Customer Satisfaction: The Case of a Greek Commercial Bank

Papathanasiou Spyros1*, Mylonas Pavlos2, Kenourgios Dimitrios1

1 National and Kapodistrian University of Athens, School of Economics and Political Sciences, Department of Economics, Division of Business Economics

& Administration, Finance, 1 Sofokleous Str. Athens, Greece.

2 Social Sciences, Faculty of Banking, Hellenic Open University, Athens, Greece Roumelis Street, Argyroupoli, Greece.

*Corresponding Author

Spyros Papathanasiou,

National and Kapodistrian University of Athens, School of Economics and Political Sciences,

Department of Economics, Division of Business Economics, Administration, Finance 1, Sofokleous Str. Athens, Greece.

Tel: + 30 210 3689480

E-mail: spapathan@econ.uoa.gr

Received: March 30, 2018; Accepted: May 25, 2018; Published: May 31, 2018

Citation: Papathanasiou Spyros, Mylonas Pavlos, Kenourgios Dimitrios. Bank Mergers - Takeovers and Customer Satisfaction: The Case of a Greek Commercial Bank. Int J Financ Econ Trade. 2018;2(2):11-17. doi: dx.doi.org/10.19070/2643-038X-180003

Copyright: Papathanasiou S© 2018. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.

Abstract

The aim of this study is to examine the correlation of the service quality dimensions to the overall customer satisfaction in the Greek banking sector, following its restructuring due tothe mergers and the takeovers during the current financial crisis period (2009 - 2015), and to analyze in particular the case of Piraeus Bank, the biggest Greek commercial Bank. The research conducted so as the data to be collected, was drawn from a customer sample of the Piraeus Bank and as for the measurements used, are based on the widely accepted SERVQUAL model, as it is proposed by Parasuraman et al., (1988) [18]. where the five dimensions of service quality merged: reliability, responsiveness, empathy, assurance and tangibles. According to the results, all service quality dimensions are positively related to the customer satisfaction. The greatest impact, regarding customer satisfaction, was observed most in the dimensions of empathy and reliability. Moreover, it was discovered that a certain type of customer discontent is on the verge of being manifested among the considered bank services.

2.Introduction

3.Literature Review and Conceptual Framework

3.1 Customer satisfaction in banking sector

3.2 Satisfaction and Service Quality

4.Research Hypotheses and Research Methodology

4.1 Research Hypotheses

4.2 Sampling and data collection

4.3 Research Methodology

5.Analysis and Presentation of Findings

5.1 Empirical Results

5.2 Descriptive Statistics

5.3 Hypothesis testing

5.4 Multiple regression results

6.Conclusions

7.References

Keywords

Mergers-Takeovers; Customer Satisfaction; Banking; Greece; SERVQUAL Model; Service Quality; Behavioral Finance.

Introduction

Customers are becoming more and more quality aware, their demands are multiplied rapidly and therefore the banks are forced to provide excellent services to their customers in order to gain a sustainable competitive advantage. The developments of globalization, the emergence of new forms of banking, the recent takeovers - mergers in the Greek banking sector during the economic crisis period such as we are experiencing, maximize the importance of the quality of services supplied by the banks to their customers and in correspondence of the satisfaction received.

To a greater extent, the quality of services seems to be the key factor for customer satisfaction. Thus, at the same time Greek banks are trying to coincide with the new economic developments through mergers and undertake the responsibility in order to contribute to the creation of large banking groups, customer perception of the quality of services would be concerned as a complex process with multiple dimensions so as to align the satisfaction with the bank customer.

Previous research by Siddiqi (2011) [25] and Regavan, Mageh (2013) [22] based on older scientific studies by Parasuraman, et al., (1985) [17], Cronin and Taylor (1992) [4], indicated that the quality of service leads to customer satisfaction considering the improvement of the quality of services increases the likelihood of customer satisfaction. Moreover, all mergers and takeovers are not always willingly accepted by the customers, while their respective reactions to these are not often considered.

Νowadays, bank customers are at a disadvantage regarding their negotiating statement, mainly due to the economic crisis, the financial measures and the restriction of capital movement (capital controls). However, there is no further guarantee that any position, which is on active at the present, will still in valid for the time being. Therefore, the quality of bank services need to be constantly valued, as it is considered to be the essence or the core of the strategic competition [13]. Good knowledge of the characteristics and advantages of the services provided by the banks contributes to their success and their resilience in the international banking competitive environment [8].

The measurement of customer satisfaction correlated with the SERVQUAL model is an innovative and new concept regarding the Greek banks. In that respect, in Greece a small amount of survey research has been performed with the prospect of exploring the significance of service quality and its interaction with the satisfaction. Therefore, this deficiency has been the mobilizing force of this study so as to purvey with new incentives the managers in banking sector, consider new policies for proper strategies and improve customer satisfaction in today's competitive banking environment. Not only the financial institutions but the academic community as well, with an important, new investigative proposal basically referring to the satisfaction of investors will this study empower.

First of all, the aim of this project is to examine the correlation of the service quality dimensions to the overall customer satisfaction in the Greek banking sector, following its restructuring because of the mergers and the takeovers during the current financial crisis (2009 to 2015) and to discuss in particular the case of Piraeus Bank, the biggest Greek commercial Bank.

Piraeus Bank has rapidly grown in size and activities, representing today the leading Bank in Greece with 30% market share in terms of loans and 29% of deposits. Headquartered in Athens, Greece, with approximately 17.0th employees, operating in 7 countries, Piraeus Bank Group offers a full range of financial products and services to approximately 6mn customers.

The presented issue of the current paper introduces an interesting field of study and represents a variety of reasons: Firstly, it contributes to existing knowledge, as notable findings are recorded, compared with the existing empirical studies of researchers on an international basis. Secondly, it offers incentives for future research, in view of the comparison with the existing experiential studies of researchers. Thirdly, it is possible to contribute to a bank agency so as to strengthen its position against competitors in the industry, considering the importance nowadays as the banking industry possesses an intense competitiveness. Finally, it redounds to the enrichment of knowledge referring the relationship between Bank mergers - takeovers and customer satisfaction in the banking industry.

In addition, this paper contributes to the field of behavioral finance by determining the possible relationship which is developed between mergers-takeovers of banks and the customer satisfaction. Recent research has highlighted the importance of mergers-takeovers, in reference to the application of customer satisfaction.

In particular, the research of this study intends to give answers to the following questions:

I. Which are the specific quality features of a service that impact the satisfaction of the customers of the bank up for consideration according to the new conditions of economic crisis?

II. How does the proposed SERVQUAL model redeem retail banking of the under consideration bank after the affect of the mergers and takeovers?

III. Which is the customer’s attitude representation towards the quality of banking services after the mergers and acquisitions of Piraeus Bank?

IV. Which is the perception of the overall customer’s attitude towards the Piraeus Bank services?

Therefore, the paper is composed of five sections. Section 2 presents briefly the literature review about the importance of measuring customer satisfaction. Section 3 describes the data and the methodology used. In addition, it explains the reason why the measurement of customer satisfaction in this study is based on the SERVQUAL model, developed by Parasuraman, et al., (1990) [19]. In section 4, the outcomes and findings of the research are represented. Finally, in Section 5, the conclusions and the recommendations are concluded.

Literature Review and Conceptual Framework

An increased number of banks have directed their strategies to customer satisfaction. Researchers have shown that customer satisfaction is the determining factor to customers’ judgment behaviors. Indicatively, Mualla & Deep (1998) [14] and Baumann et al., (2007) [2] concluded that satisfaction is an intermediate criteria between the older perceptions of service quality and the current ones. Zeithmal and Bitner (2003) [26] claimed that the term “customer satisfaction” may refer to the future intentions of customers towards the provider’s services which are related more or less to the customer's attitude. Customers perceive services in terms of quality of service and in terms of their satisfaction as a common approach. According to Beerli, Martin and Quintana (2004) [3], customer satisfaction is a measure of the amount it can reach the existing bank to fulfill the general expectations of a customer and how far and/or close the existing bank does achieve to draw the customer’s ideal bank in his mind.

All enterprises and organizations have understood the importance of measuring customer satisfaction, which can be regarded as the most reliable feedback system for the company as it indicates the customer’s opinion in a substantial and immediate manner (Gesron, 1993) [6]. For this reason, customer satisfaction should be interpreted through a set of measurable parameters, or in other words factors that the staff or the customer can understand and affect [1, 7, 16].

Measuring customer satisfaction provides an overall efficiency of the company and determines its possible superiority in relation to the competition. The quality of services is considered a critical success factor for organizations/enterprises that differentiates them from their competitors [9]. Indicatively, Cronin and Taylor (1992) [4] showed that the perceived quality of services leads to customer satisfaction, Ravichandran et al., (2010) [24] concluded that the increase of bank services quality can increase customer satisfaction, Regavan and Mageh (2013) [22] concluded that quality services are a basic and the most important factor affecting the overall customer satisfaction and Razak et al., (2013) [23] in their results showed that there are factors that affect customer satisfaction towards the quality of services offered by a bank. Therefore, the relationship between these two aspects can provide banks with knowledge about the improvement of their services, especially for the development of competitive advantage.

Research Hypotheses and Research Methodology

In order to fulfill the research objectives, the following hypotheses are formulated:

1st: There is a positive correlation between tangibility and satisfaction of Piraeus Bank customers.

2nd: There is a positive correlation between the reliability of the bank and the satisfaction of Piraeus Bank customers.

3rd: There is a positive correlation between the response of the bank and the satisfaction of Piraeus Bank customers.

4th: There is a positive correlation between the assurance that the bank provides and the satisfaction of Piraeus Bank customers.

5th: There is a positive correlation between empathy by the bank and the satisfaction of Piraeus Bank customers.

Data were collected from a random sample of 218 clients of Piraeus Bank through questionnaires answered by personal interviews or by a social network the period from October 2016 to January 2017. The electronic approach provided a relatively easy way to examine the views of a large group of customers at a low cost and in no time at all. Also, respondents could maintain their privacy, in responding the questions that existed in electronic form and submitting electronically their answers.

The survey was addressed to individuals aged 18 and over, considering that every person over 18 can responsibly deal with daily banking operations and products.

The results of this research are related to customers of a particular financial institution, Piraeus Bank, and therefore conclusions cannot be generalized for all financial institutions of the same sector in Greece.

The time period (October 2016 - March 2017) in which the survey conducted was short, and in order to receive as large a customers’ response as possible regarding the completion of a questionnaire, it is resolved to be measured only customer perceptions and not expectations, so as to be avoided being tedious and time consuming, adopting the idea of the SERVQUAL model, it is more possible to be used in several ways.

This research applies the SERVQUAL model to measure customer satisfaction in the banking sector [18], regarding the case of Piraeus Bank.

The preparation of the questionnaire used for the study was based on the literature review. The first part of the questionnaire provides general information according to the respondent. The quality service features of the five (5) dimensions of our model used in the second part, consisting of 26 questions, which are the independent variables of this research. The third part of the questionnaire explains customer satisfaction, which is the dependent variable of this study.

The respondents were asked to answer questions in a seven grade Likert-type scale, and in the second part of the questionnaire a scale of 1-7 is introduced, with the first one meaning "I strongly disagree" up to the seventh one meaning "I strongly agree." In the third part there is a scale from 1 (very unsatisfactory) to 7 (very satisfactory). A similar scale was used by Parasuraman et al. (1985 [17], 1988 [18], 1991 [20], and 1994 [21]) in the SERVQUAL model, but also by Cronin and Taylor (1992) and Dutka, (1995) [5] to measure customer satisfaction. Noteworthy that the number of questions in the SERVQUAL type questionnaire, in the literature reviews was not found to be fixed.

The method used is a descriptive analysis as customer satisfaction mean analyses, reliability analysis with a Cronbach Alpha index and multiple regression analysis as well as hypothesis testing to get a comprehensive picture on the profile of respondents, and the quality of services offered by the concerned bank to its customers compared to the five dimensions of the SERVQUAL scale. In particular, Cronbach’s Alpha is used as a measure of the internal consistency of a test or scale and applies values between 0 and 1. More specifically, internal consistency defines the extent to which all the items in a questionnaire measure the same concept and check whether the interrelatedness of the items exists (Tavakol, Dennick, 2011). Spearman’s rho correlation is a nonparametric measure of statistical dependence between two variables. This measure takes values between -1 and 1, showing the extent of how correlated the variables are through the process of the survey (Caruso, Cliff, 1997).

Moreover, a main reason for adopting the SERVQUAL model is that as it was found out Piraeus bank focuses to the quality of services which is an important factor for customer satisfaction. However, it is remarkable to state that the questions concerning the quality of services in this study do not concern the gap analysis based on Parasuramanet et al., (1988)[18], but only the customer's perception of the quality of services provided by the organization. The data collected from the completed questionnaires was analyzed with the use of the statistical software SPSS.

Analysis and Presentation of Findings

On the basis of all the 218 sample respondents, the percentage of men and women are 52.3% and 47.7% respectively, a numerical ratio of nearly 1 by 1 which is considered very satisfactory in relation to their preferences in order to avoid any influences from the specific characteristics of each sex. According to the survey, based on the total of respondents, a percentage of 0.8% were between 18 to 24 years, 11.7% were between 25 to 29 years, 71.9% were aged 30 to 44 years, 14.8% were aged 45 to 64 years and 0.8% were older than 65 years old. Regarding the individuals’ jobs the majority of the respondents worked in the private sector (51.6%), influenced by the public employees (23.4%) and freelancers (13.3%), while 39.1% of them are customers of the bank with a cooperation of 1-4 years and 38.3% are customers of the bank with a cooperation of 5-9 years, which in correspondence with the age rates indicates that the majority of respondents who became customers of Piraeus Bank derived from other domestic financial institutions, following mergers and takeovers performed in the last years in the Greek banking sector.

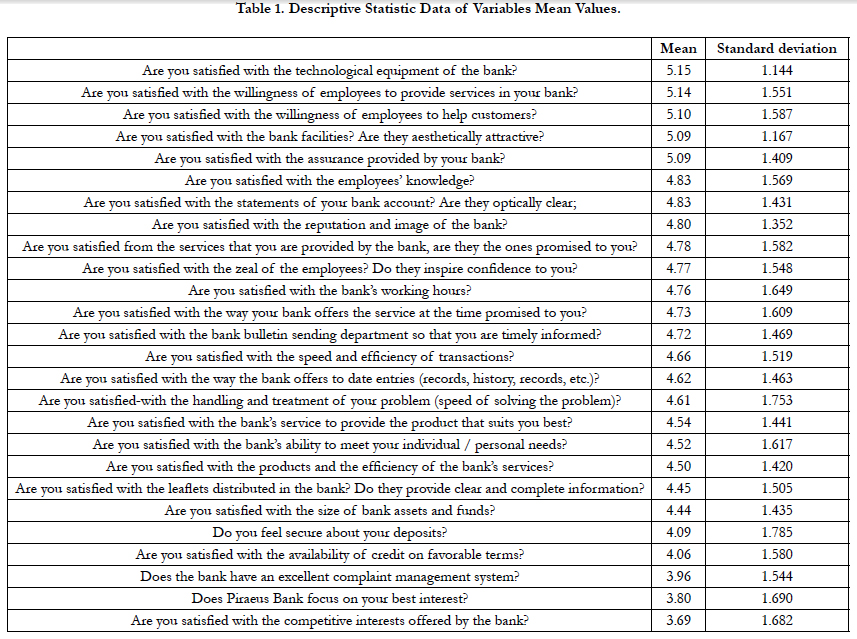

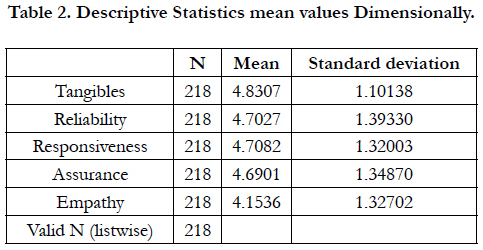

As far as descriptive statistics concerned, in Table 1 are enlisted twenty-six questions of service quality and their descriptive statistic data of variables mean values, where the respondents were asked to evaluate. From Table 2 considering the fact of being more aggregated an image according to the questions - parameters of the questionnaire based on their rankings on 5 dimensions, survey respondents identified at a larger extent the service quality parameters relating to the tangibility (mean value 4.83 and standard deviation 1.101).

Τhe quality parameters included in dimensions "Reliability" and "Responsiveness" with mean values 4.70 and standard deviation of 1.393 and 1.320 respectively are the next in sequence. By a narrow margin, the dimension of "Assurance” with mean value 4.69 and standard deviation 1.348 trail behind while the smallest mean value is observed in the "Empathy" dimension (value 4.15 and standard deviation 1.327). Additionally, in accordance with the dynamic parameter of customer satisfaction a mean value of just 4.55 and standard deviation 1.462 is claimed that in future, connecting with the perceptions of its customers and the improvement of the data that affect it should be bank’s high priority.

The values of the standard deviations of each dimension is above the unit concerning the data is widespread, while the respondents of the survey provide a variety of views.

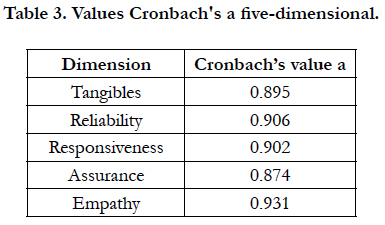

In order to verify the continued use and durability of the five SERVQUAL dimensions, as examined in Table 3 and resulting from the dimensions, as examined in Table III and resulting from the dimensions it was found out that the reliability of the variables is satisfactory since the extent of Cronbach alpha coefficients ranges from .895 to .931, ensuring the validity of each dimension.

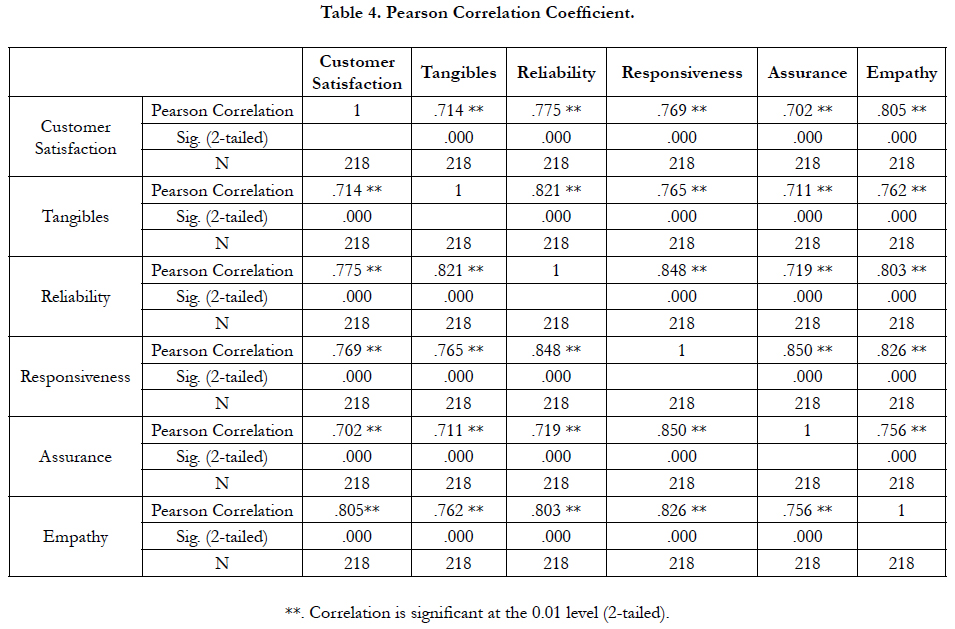

A hypothesis testing was conducted to reveal the relationship between each dimension of this study, measuring the intensity of the variable dependence degree. Also, the determination of this intensity is performed through the parameter called Pearson’s linear correlation coefficient with values ranging from -1 to = 1.

Regarding the Table 4, it results that the values of the dimensions tangibility, reliability, responsiveness, assurance, and empathy involve a positive and strong relationship with the customer satisfaction measuring values ranging from .702 to .805. Needless to say, each relationship is changing towards the same positive direction, i.e. as soon as the one is increased the other is increased as well.

There is a significant relationship (p = 0.000 <0.05) between tangibility and customer satisfaction. Therefore, the null hypothesis is rejected and they are assumed that tangibility and customer satisfaction are positively related (r = 0.714).

There is a significant relationship (p = 0.000 <0.05) between reliability and customer satisfaction. Therefore, we are rejecting the null hypothesis and we assume that reliability and customer satisfaction are positively related (r = 0.775).

There is a significant relationship (p = 0.000 <0.05) between responsiveness and customer satisfaction. Therefore, the null hypothesis is rejected and we assume that responsiveness and customer satisfaction are positively related (r = 0.769).

There is a significant relationship (p = 0.000 <0.05) between assurance and customer satisfaction. Consequently, we reject the null hypothesis and we assume that assurance

and customer satisfaction is positively related (r = 0.702).

There is a significant relationship (p = 0.000 < 0.05) between empathy and customer satisfaction. Accordingly, the null hypothesis is rejected and it is confirmed that empathy and customer satisfaction are positively connected (r = 0.805).

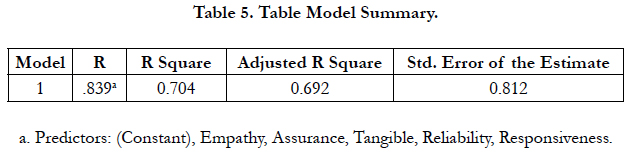

Regarding Table 5, it is concluded that the customer satisfaction is interpreted by 70.4% (R2 = 0.704) though the five dimensions of our model and therefore it may be said that there is a very strong relationship between these variables.

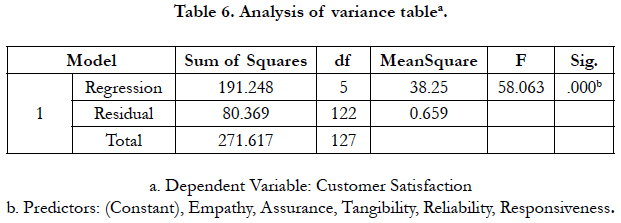

Additionally, from Table 6 of variance analysis it is noted (sig = 0.000 <0.05 and F = 58.063) that the assessed regression line is considered statistically significant and the proposed model contributes significantly in predicting both customer satisfaction and its volatility.

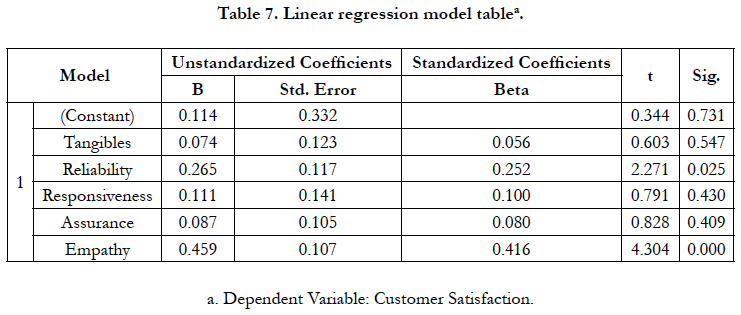

The linear regression model been fitted to the data is as follows:

Customer satisfaction = 0.114 + 0.74 (tangibility) + 0.265 (reliability) + 0.111 (responsiveness) + 0.87 (assurance) + 0.459 (empathy)

The size of each coefficient indicates how satisfaction increases when the corresponding variable is increased by one unit.

Afterwards the analysis with the data collected in Table 7, it is noted that the present study is able to determine which of the examined dimensions act on satisfaction more. In addition, the dimension of empathy possess greatest impact on customer satisfaction, followed by the dimension of reliability. So, empathy (p = 0.000 <0.05) and reliability (p = 0.025 <0.05) are statistically significant.

Conclusions

Compared with the general economic environment it is defined that the horizontal mergers and takeovers of Piraeus Bank were performed in order the bank can meet with and confront the current financial conditions. However it should be marked that customer satisfaction is a dynamic parameter of the business organization. Customer’s preferences and expectations can be redounded by the changes in the current market.

Moreover, delving into deeper analysis of the application of the model SERVQUAL the results of our study showed that "empathy" and "reliability" seem to be the most important dimensions, in contrast to previous similar studies in the past where it was found out that tangibility, reliability and empathy are substantial for customer satisfaction while according to Mengi (2009) [12] responsiveness and assurance were those which were found significant. Kumar et al., (2010) [10] and Lai (2004) [11] investigate that assurance, empathy and tangibility are considerable factors. In addition, the data collected from the completed questionnaires was analyzed with the use of the statistical software SPSS.

Regarding the dimension of empathy, it seems that customers are prone to desire a higher degree of interaction with the bank's staff, they expect a personalized service and they are notified that the front-line staff is able to understand their specific needs. On the other hand, regarding the dimension of reliability, customers do not seem to be satisfied with the services that the bank had promised, provided that they continue not to expect on its handling of their problems, and finally they are believed that their best interests are side lined. Consequently, the success of a special relationship between the financial institution and the customer are not only based on the financial or non - financial results, but also on aspects of service quality.

One other major conclusion is that all dimensions of service quality are highly correlated with customer satisfaction affecting in a positive direction, according to the values ranging from 0.702 to 0.805. This fact can be shown also in studies or surveys that have taken place in the banking sector by the scientific community. Indicatively, Zeithaml et al., (2003) [26], Beerli, et al., (2004) [3] found a strong and significant relationship between customer satisfaction and quality of banking services, as well as Mohammad et al., (2011) [15], found that tangibility, reliability, responsiveness, assurance and empathy had a significant influence on customer satisfaction, and finally Ravichandran et al., (2010) [24] concluded that the increase of bank service quality can increase customer satisfaction and Regavan and Mageh (2013) [22] assumed that quality services are the most fundamental and the most significant impact affecting the overall customer satisfaction.

Last but not least, an important element for Piraeus Bank, based on the research results, it is the low overall regard (only 4.55) of respondents towards the bank's services. In some degree it could be argued that a kind of customer dissatisfaction is on the verge of emerging and the risk of customer’s participation in activities against the organization, such as negative spread of information as far as the bank concerned through mouth-to-mouth communication and social media might be a limited significant factor.

On conclusion, Due to the results of this paper and regarding the approaches and proposals of previous researchers it would be clearly formulated that the needs and views of customers are changing rapidly. Piraeus Bank should continue its efforts to ensure the satisfaction of its customer’s expectations, providing high quality products and services so as to ensure the creation of trusting relationships with the customers, dealing effectively with the negative economic climate of our country in recent years.

References

- Ahmed I, Nawaz M, Usman A, Shaukat M, Ahmad N, Iqbal H. Impact of Service Quality on Customers' Satisfaction: Empirical evidence from telecom sector of Pakistan. IJCRB. 2010;1(12):98-113.

- Baumann C, Burton S, Elliott G, Kehr HM. Prediction of attitude and behavioural intentions in retail banking. IJBM. 2007 Mar 6;25(2):102-16.

- Beerli A, Martin JD, Quintana A. A model of customer loyalty in the retail banking market. Eur J Mark. 2004 Jan 1;38(1/2):253-75.

- Cronin Jr JJ, Taylor SA. Measuring service quality: a reexamination and extension. J. Mark. 1992 Jul 1;56(3):55-68.

- Dutka A. Ducta A. AMA Handbook of customer satisfaction: A guide to research, planning, and implementation. 1995.

- Gerson R. Measuring Customer Satisfaction: A Guide to Managing Quality Service. 1993. Cet ouvrage de.;113.

- Grigoroudis E, Siskos Y. Service Quality and Customer Satisfaction Measurement. 2nd ed. New Technologies Publications. p.47-57.

- Arasli H, Mehtap-Smadi S, Turan Katircioglu S. Customer service quality in the Greek Cypriot banking industry. Int J Serv Ind Manag. 2005 Feb 1;15(1):41-56.

- Lau MM, Cheung R, Lam AY, Chu YT. Measuring service quality in the banking industry: a Hong Kong based study. Cont Manag Res. 2013 Sep 1;9(3):263.

- Kumar SA, Mani BT, Mahalingam S, Vanjikovan M. Influence of service quality on attitudinal loyalty in private retail banking: an empirical study. IUP J Manag Res. 2010 Apr 1;9(4):21.

- Lai TL. Service quality and perceived value's impact on satisfaction, intention and usage of short message service (SMS). Inf Syst . 2004 Dec 1;6(4):353-68.

- Mengi P. Customer satisfaction with service quality: An empirical study of public and private sector banks. IUP J Manag Res. 2009 Sep 1;8(9):7.

- Hossain M, Leo S. Customer perception on service quality in retail banking in Middle East: the case of Qatar. Int J Islamic and Middle Eastern Finance and Manag. 2009 Nov 20;2(4):338-50.

- Mualla ND. Measuring Banking Service Quality Provided by Jordanian Commercial Banks: A field Study. Derassat for Adm Sci. 1998;25(2):335-57.

- Malik EM, Naeem B, Arif Z. How do service quality perceptions contribute in satisfying banking customers. Int J Curr Res in Business. 2011 Dec;3(8):646-53.

- Papathanasiou S, Siati M. Emotional intelligence and job satisfaction in Greek banking sector. Res Appl Econ. 2014;6(1):225-239.

- Parasuraman A, Zeithaml VA, Berry LL. A conceptual model of service quality and its implications for future research. J Mark. 1985 Oct 1:41-50.

- Parasuraman A. SERVQUAL: a multiple-item scale for measuring consumer perceptions of service quality. Journal of retailing. 1988;64(1):12-40.

- Parasuraman, A, Tahir IM, Abubakar NM. Service quality gap and customers’ satisfactions of commercial banks in Malaysia. International Review of Business Research Papers. 2007 Oct;3(4):327-36.

- Parasuraman A, Berry LL, Zeithaml VA. Perceived service quality as a customer based performance measure: An empirical examination of organizational barriers using an extended service quality model. HR managt. 1991 Sep 1;30(3):335-64.

- Parasuraman A, Zeithaml VA, Berry LL. Reassessment of expectations as a comparison standard in measuring service quality: implications for further research. J Mark. 1994 Jan 1:111-24.

- Ragavan N, Mageh R. A study on service quality perspectives and customer satisfaction in new private sector banks. IOSR J Business and Manag. 2013 Jan;7(2):26-33.

- Razak MI, Sakrani SN, Wahab SA, Abas N, Yaacob NJ, Rodzi SN. Adaptive of servqual model in measuring customer satisfaction towards service quality provided by Bank Islam Malaysia Berhad (BIMB) in Malaysia. IJBSS. 2013 Aug 1;4(14):189-198.

- Krishnamurthy R, SivaKumar MA, Sellamuthu P. Influence of service quality on customer satisfaction: Application of SERVQUAL model. Int J Business and Manag. 2010 Mar 19;5(4):117-124.

- Siddiqi KO. Interrelations between service quality attributes, customer satisfaction and customer loyalty in the retail banking sector in Bangladesh. Int J Business and Manag. 2011 Feb 28;6(3):12-36.

- Wilson A, Zeithaml VA, Bitner MJ, Gremler DD. Services marketing: Integrating customer focus across the firm. 3rd ed. McGraw Hill; 2003.