The Digital Transformation in Banking and The Role of FinTechs in the New Financial Intermediation Scenario

Omarini A*

Tenured Researcher at the Department of Finance, Bocconi University, Italy.

*Corresponding Author

Anna Omarini

Tenured Researcher at the Department of Finance,

Bocconi University, Italy.

Email: anna.omarini@unibocconi.it

Received: June 29, 2017; Accepted: August 17, 2017; Published: August 22, 2017

Citation: Omarini A (2017) The Digital Transformation in Banking and The Role of FinTechs in the New Financial Intermediation Scenario. Int J Financ Econ Trade. 1(1), 1-6. doi: dx.doi.org/10.19070/2643-038X-170001

Copyright: Omarini A© 2017. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.

Abstract

One of the main changes in the industry is becoming digitalization which is witnessing a profound transformation to the banking system. Digitalization offers new opportunities for banks to place the customer at the center of the development process. New technologies seem to be and stay in the market to disrupt the retail financial service value chain, as well as introducing new players into the competitive arena. Incumbents and new comers have innovative levers to adopt. The forces shaping these changes have led the industry to reconsider the role of banking and finance, more as an “enabler” than a provider of products and services. The article aims at defining digital transformation in the banking industry, outlining what banks and FinTech companies are both developing in the market, and also pointing out that it is not going to be the technology itself that will be the disruptor of the banking industry, but rather how firm deploys the technology that will cause the disruption.

2.Introduction

3.The Wave of Digitalization in Banks

4.Digital Transformation: How is the Bank Business going to be Reshaped?

5.Conclusion

6.References

Keywords

Digitalization; Digital Transformation; FinTech; Retail Banking; Business Model; Incumbents; Innovation.

Introduction

Banks play an important role in the economy as they operate the payment system, are the major source of credit for large swathes of the economy, and (usually) act as a safe haven for depositors’ funds. They also encompasses the provision of banking and financial products to consumers and small businesses. In doing so, banks are highly dependent on interest rates, fees and proprietary products.

From the financial crisis onward [1, 2], the time for banks to change was accelerated because of compliance issues - i.e. the second EU Payment Services Directive (PSD 2) [3]; technological innovations-including the rapid proliferation of technologies like smartphones, artificial intelligence, and big data analytics-; new competitors-financial technology startups (FinTech); and changes in customer’s attitudes and behaviors. This context makes it easier for technology start-ups to enter the financial services industry and offer products and services directly to consumers and businesses, including incumbent financial institutions.

FinTech is a word incorporating many different business and economic realities. They all have different competitive landscapes, regulatory framework, and development paces. And things are again different by countries, depending in each case of local situations potentially leading to very different approaches for the same business. Main FinTech fields of development are payments, where there are the most of players especially in mobile transfers; alternative lending and funding, such as crowd funding, social media and automated matching platforms which gain their momentum in financing small and medium enterprises as well as individuals. There is also the automated financial advice (robo-advisor), which has been invented to take care of low income clients, but it is ready to expand to high net worth individuals as well. Given that, it is essential for banks to understand that the pace of changes in financial services seems only to be increasing-as does the urge for the industry to react, because new technologies and competitors seem to be and stay in the market to disrupt the retail financial service value chain, and then change its competitive arena.

The digital vortex is the inevitable movement of industries toward a digital center in which business models, offerings, and value chains are digitized to the maximum extent possible, also creating new disruptions, and blurring the lines between industries. This can be done easily because the components of the Internet revolution are “just bits”, which become software, protocols, languages, and capabilities that can be combined and recombined in ways to create totally new innovations. These immaterial components make simple to spread them around the world, and so develop a huge number of innovations. The most successful disruptors employ “combinatorial disruption,” in which multiple sources of value-cost, experience, and platform-are fused to create disruptive new business models and exponential gains [4].

The forces shaping these changes have led the industry to reconsider the role of banking and finance, more as an “enabler” than a provider of products and services.

The specific concern of the article is to outline the main aspects regarding the digital transformation in the banking industry, and then move on trying to understand its main consequences for banks besides the entrance of FinTech and the evolution of a new wave of competition in the market. Paragraph 2 describes the meaning and main impacts of digitalization in banks; paragraph 3 outlines the idea of reshaping the banking industry. And in the conclusion paragraph is outlined the priorities for a bank to take care to face this new environment.

The Wave of Digitalization in Banks

Digitalization is changing the rules of the game in many industries through possible disruptions of business models, and this results in the emergence of a much more complex and dynamic ecosystem for growth and innovation [5]. The digital infrastructure has accelerated the emergence of new technologies-social media, cloud computing, analytics and big data, wearable devices, 3D printing, and intelligent autonomous systems, to name some recent ones-that enable transformations in the way we live and work, how companies organize, as well as the structure of entire industries [6-8] (See Box 1).

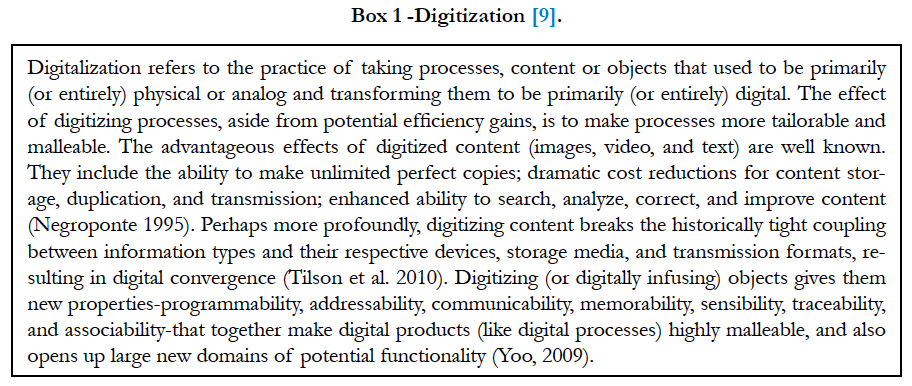

New entrants-known as FinTech companies-have entered the bank market by selling payments, in particular a number of them are targeting the emerging mobile payments market, personal lending, general insurance, and more recently financial advisory which have historically been regarded as a more complex service.

Figure 1. Customer segments and products of leading financial-technology companies 2015 (% of total) [10].

As shown in Figure 1, they have targeted the three main retail banking areas, where it is possible to work at reducing the gap between customer’s satisfaction and expectations. In doing so, they have started looking for and leveraging the relationship with customers by developing their business models on the following main characteristics:

- Simplicity;

- Transparency;

- Ease of customer acquisition;

- Ease of distribution and commercial attractiveness; and

- Specialization.

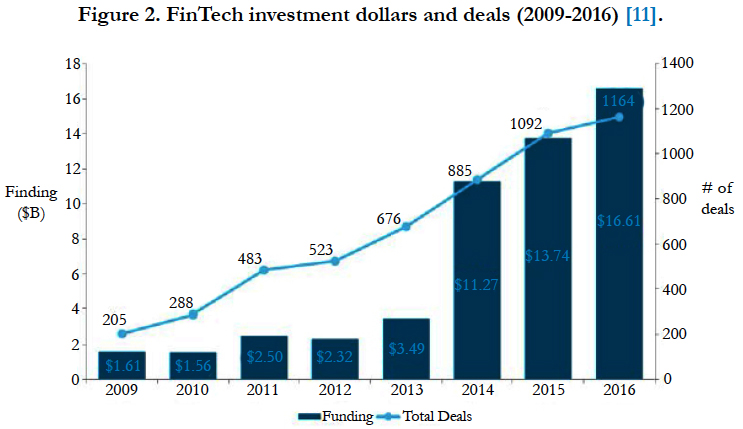

All of this above refers to the perceived idea that some financial services (such as payments, lending, and insurance) can be considered a kind of commoditized products, where the customer’s purchasing decision is mostly driven by price. Despite traditional banks, FinTech companies share many of the same attributes, in terms of being young, aspirational, visionary and capable. They are also freed from the constraints of legacy technology, and highly specialized. They are backed by rising levels of venture capital flooding into this sector (See Figure 2).

All this makes them to be able to redefine the way customers do banking, and also raising their expectations for traditional banks in the process. In particular:

The perceived advantages of FinTech firms extend far beyond their ability to innovate and move quickly. From the customers’ perspective, FinTech firms have value in being easy to use (81.9%), offering faster service (81.4%), and providing a good experience (79.6%) [12].

According to Capgemini (2016), globally, nearly two-thirds of customers (63.1%) use products or services offered by FinTech firms.

Penetration is highest in the emerging markets. In Latin America, 77.4% use Fintech products or services, followed by Central Europe at 68.9% and Middle East and Africa at 63.3% [12].

This happens because customers in emerging markets find in FinTech the way to financial inclusion, likely reflecting gaps in services provided by traditional banks. The same report also highlights the fact that younger customers are more likely to turn to Fintech firms, but the appeal of Fintech is expected to intensify among customers of all ages.

These companies can be described as:

A dynamic segment at the intersection of the financial services and technology sectors where technology-focused start-ups and new market entrants innovate the products and services currently provided by the traditional financial services industry [13].

A portmanteau of financial technology that describes an emerging financial services sector in the 21st century. Originally, the term applied to technology applied to the back-end of established consumer and trade financial institutions. Since the end of the first decade of the 21st century, the term has expanded to include any technological innovation in the financial sector, including innovations in financial literacy and education, retail banking, investment and even crypto-currencies like bitcoin [14].

A part of the answer to the fundamental questions facing our economies: lack of productivity and rising inequalities. That is why regulation is generally supporting opening up market access by introducing legal certainty to previously unregulated services. For example, the revised Payment Services Directive (in Europe) is expanding the list of activities that payment service providers can carry out to include the initiation of payments and account information services [15].

With their entrance in the market, this has matured and moved on. As a consequence, it has being re-shaped (disrupted and in many cases stimulated) by a number of trends, which can be considered both opportunities and threats to traditional banks.

For a long time, retail banking has been a kind of oligopoly market and in their article, Gardener, Howcroft, and Williams (1999) put it this way [16]:

There was a great deal of similarity between the market players, which resulted in competitors introducing similar, if not identical, competitive strategies. Financial product innovations were also quickly replicated with a corresponding reduction in the initial innovator’s reward. These strategic considerations, compounded by a herd mentality, were responsible for the clearing banks duplicating each other’s services. An exceedingly wide and diverse range of identical products was offered by each bank with the result that management in retail banking became correspondingly more complicated and less cost-effective.

With this in mind, according to Lautenschläger speech (2017) [17]:

Banks have to deal with both kinds of change: the ordinary and the extraordinary. They have to find their way in a digital world; they have to adhere to stricter rules and make the best out of very low interest rates.

In future, the main factors to stay competitive in the market will depend greatly on the visions and strategies banks develop and implement.

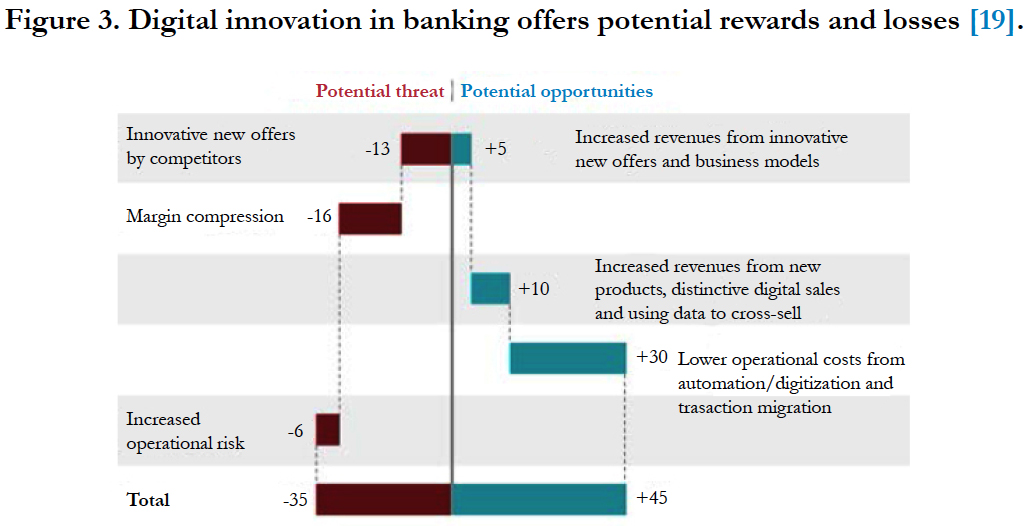

As new entrants are putting pressure on banks’ margins in various products [18], they have started rethinking the way they do business. There is, of course, significant variation among banks in reacting to digital disruption Globally, more innovative incumbent banks and financial institutions are moving rapidly to embrace digital. Most of them have invested heavily in transaction migration. They have also significantly upgraded web and mobile technologies and created innovation and testing centers, both inhouse (i.e. JPMorgan) and through an innovation division separate from the broader business (i.e. Citi Fintech).

Some other banks have decided in developing new products (some of them new FinTech products in end-to-end digital banking, digital investment services, electronic trading, and online cash management); while others are also collaborating with FinTech to improve their consumer offerings. This is the case of JPMorgan with OnDeck - which is a lending platform for small and medium enterprises that is able to process loans in just a day -; Roostify – which is a mortgage process provider that makes the online lending process faster, less costly, and more transparent for everyone involved -; and Symphony - which is a solution provider for sales and trading, operations, etc.

There are many other leading banks, among the most ranked at the upper stage of digital transformation, and the list includes Banco Santander, Bank of America, Barclays, BBVA, BNP Paribas, Citi, HSBC, RBS, Société Générale, UniCredit and Wells Fargo. Finally, it is interesting to outline the following common forecast [19]:

By 2018, banks in Scandinavia, the United Kingdom, and Western Europe are forecast to have half or more of new inflow revenue in most products coming from digital sales. Those in the United States are expected to trail them but are still forecast to see significant new inflow revenue come from digital. Among bank products, savings and term deposits, as well as bank services to small and midsize enterprises, are expected to see more than half of new inflow revenue coming from digital by 2018 (See Figure 3).

All this above seems turning everything to the power of the incumbents, which need to look for a response, both at the individual level and as a system. Infect it is urgent for them to counteract the digital revolution because the way customers do their banking have drastically changed:

Retail customers now expect to be able to integrate e-commerce, social media and retail payments. They also expect to be able to switch seamlessly across digital platforms. These are not areas of strength for many banks; given their heavier compliance obligations, banks have traditionally invested more in security and resilience of their systems rather than optimizing the user experience [20].

Even though everything seems to go digital, it must be said that any initiative where the technology is the first item on the managers’ agenda will not be a disruptor unless new technologies will change their business; it will merely be an upgrade to existing methods.

Most banks are bogged down by aging technology and siloed businesses, making it difficult for them to move with speed and agility. But, consumers’ behavior is changing dramatically, and all this has important impacts primary on the bank distribution and sales strategies. In particular, these impacts regard:

1. A significant shift from branch dependence to digital preference; 2. A redefinition of the drivers of bank consideration and purchase; 3. An increase in demand for digital account opening [21].

Under these circumstances the underlying principles of strategy are enduring, regardless of technology or the pace of change, so every bank must start a process of change looking at the business model first, and return to customers “as individuals and human being” as a second step [22].

Given that, there are multiple challenges in incorporating innovation into banks’ organizations, including aligning innovation with strategic priorities, building capabilities to ensure agile development and prototyping, as well as commercializing solutions.

Digital Transformation: How is the Bank Business

going to be Reshaped?

Digital transformation is not really a pure technological revolution. Indeed, it is the driving force of the third industrial revolution which concerns the development of new information and communication technologies, where the increased usage of digital devices and digital platforms are transforming the way customers do banking, change market expectations, and transform the model of financial intermediation as well.

Digitization of products, services, and business processes allow disruptive players to deliver the same value a traditional competitor provides-and even augment it-without having to reproduce the conventional value chain. In fact, that is the objective of digital disruption: to provide superior value to the end customer-either a consumer or another business-while avoiding the capital investments, regulatory requirements, and other impediments of encumbered incumbents with a new and different business model.

We also see this dynamic in the way FinTech startups are disrupting banks by unbundling their products and services-seizing a share of their most profitable business, while avoiding the barriers to entry that come with being a full-service bank.

This underlines that the evolution of relatively inexpensive platforms, which can disseminate content on a broader level, is making the content as valuable as it ever was. And this happens against any idea of an increased commodized financial range of services. Even though the competition is pushing the prices down to a given level that approximates zero, this is not something that the content producers necessarily embrace, but they are forced to be into it by the nature of the technological change, and overall because of the many computer-mediated transactions. This means that banks have to grasp the economic implications of cheap and ubiquitous information on and about their core business. They have to start gaining a keener understanding of the potential for technology to reconfigure their industry.

In our opinion, all this starts from the service dominant approach, because banks have to compete through service not with services. The last statement is about more than adding value to bank products. It has to do with the entire organization viewing and approaching both itself and the market with a service dominant logic, and paying more attention on the fact that people do not buy what you sell; they buy what you stand for, and because of that every bank and FinTech company are “in the business of being chosen”[22].

Said that, the key factors useful to start developing an idea of the banking of tomorrow are the followings:

- Banks sell services, and most of them are characterized by high credence qualities and they are highly contextual;

- Some of these services may involve perceived high-risk exchange encounters;

- They are most based on professional capability; and

- In a context of professional services, professionals are responsible for the delivery of such services, which is their primary commitment toward the customer.

At this stage, there are three main factors for a bank to consider in its vision and strategy, and they are: technology, content and trust. Internet and its evolution seem to make banks inevitably become victims of disintermediation as more activities become available online. Technology also started breaking up value chains, and strategists could no longer take their value chains as a given: they had to make hard choices about which pieces to protect, which to abandon. But on this hand the picture is not necessary completely bleak for banks. They perform several functions, and not all of them will be affected by computer networks (i.e. their safe deposit business, where new entrants were less interested in offering them at the beginning).

Content is the value to be transferred and be protected in terms of competences developed so far and rooted in the long-lasting bank-customer relationships as well.

Finally there is trust, which is the glue of every relationship, especially for many financial services, that are credential goods and fiduciary based (such as advisory service, insurance, etc.).

The future of banking is going to be between a host of new digital players, where the value added - they deliver - regards the technology driven process which makes faster, more efficient and transparent the delivery of many financial services (payment, lending, insurance, etc.). And in these group there are companies - pure FinTech - which have names like Zopa, Smartypig, MoneyFarm, Nutmeg, Betterment, etc. On the other hand there are new banks, which were born from scratch, like Atom, Starling, Monzo in the UK. There are also few large banks who find it hard to change, but are adapting as fast as they can their digital transformation. And finally, there are small banks and cooperative ones, which are still working on their recovering from the financial crisis before facing the challenge of their digital business transformation.

Conclusion

Staying competitive in the future will depend greatly on the decisions banks make today. Events of the past few years have shown the price that they might have to pay for poor strategic decisions or from the adoption of similar business models in the retail banking industry. Given that the problem with innovation is that it is unpredictable in terms of timing, scale and consequences, also the future of banking expects the landscape to be shaped strongly by both digital technology and non-traditional competitors.

The big difference between the evolution of Internet during the 90’s and the digital transformation, at present, regards the fact that digital has been dramatically reshaping how people bank since the evolution of mobile has entered the market, and where software and Internet connectivity have become the rules for developing platforms and digital ecosystems. Platform are a kind of a plug-and-play business model that allows multiple participants (producers and consumers) to connect to it, interact with each other, and create and exchange value.

The more user-friendly features they have the more they develop in the market, especially if they can increase interaction and personalization which are increasing demanded by the market. All that is transforming the traditional model of face-to face interaction with important consequences on authentication, assistance, contents to deliver, a new role on the advice side. On the other hand there is a completely new approach towards data, given the new model of interaction between providers and consumers. The iPhone, for example, is a key platform on which that app ecosystem operates. There is every reason to expect financial services to make a similar transition to an increasingly interconnected digital world.

It is true that as products and services increasingly have embedded digital technologies, it is becoming more difficult to disentangle business processes from their underlying IT infrastructures. Digital platforms are enabling crossboundary industry disruptions [23], thus inducing new forms of business strategies (e.g., [24]).

Also FinTech companies have a tremendous potential to revolutionize access to financial services, improve the functioning of the financial system, and promote economic growth, but, at the moment, we think they are far from the talk of “disruption”. And, this is because more often than not, there is a banking organization somewhere in the FinTech stack, and is also worth outlining that (2016) [25]:

In the US and Europe, only a very small fraction of the current consumer banking wallet has been disrupted by FinTech so far. However, this is likely to rise. Greg Baxter, Citi's Global Head of Digital Strategy, notes that we are not even at "the end of the beginning" of the consumer disruption cycle in Western Europe and the US. Greg's team estimates that currently only about 1% of North American consumer banking revenue has migrated to new digital business models (either at new entrants or incumbents) but that this will increase to about 10% by 2020 and 17% by 2023. We are in the early stages of the US and European consumer banking disruption cycle, therefore we note that this estimate is subject to considerable forecast risk. However, an open question remains as to whether incumbent banks in the US and Europe can embrace innovation, before FinTech competitors gain scale and distribution.

All this makes a bank to consider its moving from facing the new competition to developing new forms of collaboration. And this is because, as third-party application developers rely on smartphone sensors, processors, and interfaces, FinTech developers need banks somewhere in the stack for such things as:

(a) access to consumer deposits or related account data;

(b) access to payment systems;

(c) credit origination; or

(d) compliance management.

Given that, the main issue to participate in a given value network reside dynamically within the control points of the chains, where there are the positions of greatest value and/or power. The banks or the companies that hold these positions have a great deal of control over how the network operates and how the benefits are redistributed.

Finally, we think banks may need to reconsider their standard practice of offering the full range of banking products. Because it is not going to be the technology itself that will be the disruptor, but rather how firm deploys the technology that will cause the disruption.

References

- Alessandri P, Haldane A (2009) Banking on the state. BIS Rev 139: 1-20.

- Wehinger (2008) Lessons from the Financial Market Turmoil - Challenges ahead for the Financial Industry and Policy Makers. Financial Market Trends 1-40.

- The proposed legislation encourages increased openness of a bank’s system architecture, and obliges banks to make their systems and account transaction data accessible to cardless, account-to-account payments systems (e.g. PayPal) and account aggregation services, such as personal finance management apps.

- Varian H.R. (2001) The economics of information technology.

- Iansiti M, Levien R (2004) The Keystone Advantage: What the New Dynamics of Business Ecosystems Mean for Strategy, Innovation, and Sustainability, Harvard Business School Press, Boston. 1-12.

- Agarwal R, Guodong G, DesRoches C, Jha AK (2010) Research Commentary- The Digital Transformation of Healthcare: Current Status and the Road Ahead. Inform. Systems Res. 21(4): 796-809.

- Dhar V, Sundararajan A (2006) Does IT Matter in Business Education? Interviews with Business School Deans, Center for Digital Economy, Research Paper No. CeDER-06-08, New York University. 1-22.

- Lucas JrH, C, Agarwal R, Clemons EK, El Sawy OA, Weber B (2013) Impactful Research on Transformational Information Technology: An Opportunity to Inform New Audiences. MIS Quarterly 37(2): 371-382.

- Fichman R.G., Dos Santos B.L., Zheng Z.E., (2014) Digital Innovation as a Fundamental and Powerful Concept in the Information Systems Curriculum, MIS Quarterly Vol. 38 No. 2, June, p.333.

- Dietz M, Khanna S, Olanrewaju T, Rajgopal K (2016) Cutting through the noise around financial technology, McKinsey Reviw.

- CB Insights / Analysis: State Street (2017), from the speech of Sheriff Akbar, 2017, Technology on the Rise, Are You Ready? Speech at Bocconi University on June 9th for the Executive Master in Finance.

- CapGemini (2016) World Retail Banking Report. 18-21.

- PwC (2016) Blurred lines: How FinTech is shaping Financial Services. Global Fintech Report. Also available https://www.pwc.com/gx/en/industries/financial-services/fintech-survey/blurred-lines.html

- http://www.investopedia.com/terms/f/fintech.asp#ixzz4hExZAfkC

- Coeuré (2016) From challenges to opportunities: rebooting the European financial sector. Speech at SZ (Süddeutsche Zeitung) Finance Day 2016, Frankfurt am Main, March 2nd.

- Garderner E, Howcroft B, Williams J (1999) The new retail banking revolution. SIJ 19(2): 83-100.

- Lautenschläger S (2017) ECB Fintech Workshop, Frankfurt, March 27th.

- http://www.oliverwyman.com/content/dam/oliver-wyman/global/en/2015/jun/2015_Oliver_Wyman_The_Digital_Disruption_Battlefield.pdf

- Broeders H., Khanna S. (2015) Strategic choices for banks in the digital age, McKinsey Quarterly review, January.

- Mersch Y (2015) Three challenges for the banking sector, Speech, November.

- Novantas (2017) OmnicChannel Shopper Study. Also available https://www.novantas.com/industry_insight/2017-omni-channel-shopper-survey/

- Omarini A (2015) Retail banking. Business Transformation and Competitive Strategies for the Future, Palgrave MacMillan Publishers, London. P-61.

- Christensen C M (1997) Innovator’s Dilemma. When New Technologies Cause Great Firms to Fail, Harvard Business School Press Citi GPS, Boston.

- Burgelman RA, Grove AS (2007) Let Chaos Reign. Then Rein in Chaos-Repeatedly: Managing Strategic Dynamics for Corporate Longevity. Strat. Mgmt. J., (28): 965-979.

- Citi Global Perspectives & Solutions (2016) Digital Disruption. How Fintech is forcing banking to a tipping point. 8-9.